Calculation | Online Payment | Offline Payment | Exemptions | Tax Rebates | FAQs

Municipal Corporation levies property tax on tangible real estate properties, and land owners must pay this amount within their due dates, generally annually or semi-annually. It is charged by ULB (Urban Local Bodies), and the total amount varies on-

- Property size,

- Area,

- Building Size,

- Construction etc.

Vacant properties and Central Government properties are generally exempt from this scheme. Legal entities offer tax benefits against timely payments and warn about their due date, consequences, and hassles of paying after the same.

Property Tax in Nagpur is regulated by Nagpur Municipal Corporation (NMC) and is one of the entity’s primary income sources. It offers around 5%-10% rebates in 2023 on payments before June 30 and December 31, easily accessible by all the land owners who are willing to pay their full amount at once.

For the upcoming 2022-2023 fiscal year, NMC is considering altering the property tax under the MMC Act and is planning to increase the percentage of raised government funds.

To ease your property tax payment procedures, we have all the details, including Property tax in the Nagpur calculator and easy payment modes. Let us know the facts to get the advantages of early payment rebates, lessening financial burdens from land owners.

Know more about Mumbai property tax and PCMC property tax!

Calculate NMC Nagpur Property Tax

NMC computes Property tax in Nagpur based on the Unit Area System, which is therefore equal to the tax rate’s annual value times. There is a list of factors that determine the overall due tax amount in Nagpur-

- Type of Property because of Unit Area System,

- Location of the Property,

- Basement Area,

- Ownership or Holding Age of the Property,

- Occupation Type.

- Type of Occupancy,

- Number of Floors

Formula to Calculate 2023 Property Tax in Nagpur-

Prevailing Tax Rate * Type of Building * Usage * Floors * Age * Total Carpet Area of Vacant Land.

So, suppose your property is located in central Nagpur city, serving commercial purposes. In that case, you need to pay higher property tax when compared to commercial properties situated on the city’s outskirts. Furthermore, Property Tax in Nagpur and other cities is a total accumulation of different taxes, including-

- Sewerage Taxes,

- Fire Service Taxes,

- Water Benefit taxes,

- General Water Taxes,

- Special Clean-up Taxes,

- Sewerage Benefit Taxes,

- Tree Taxes,

- Education Taxes,

- Road Taxes,

- EGS Cess,

- Large Residential Building Taxes.

To eliminate the hassle and delays in all these tax payments, ULB has comprised all these heads under property tax, making it easier for landowners to clear off their dues with a single payment.

Online Payment Procedure for Property Tax Nagpur 2023:

Government entities test and try different methods to make tax collection and payments more manageable, and one of the most opted options is the online portals. NMC launched an online tax collection portal where landowners can quickly wave off their dues in the comfort of their homes. Simple steps to pay your property tax in Nagpur online in 2023 include-

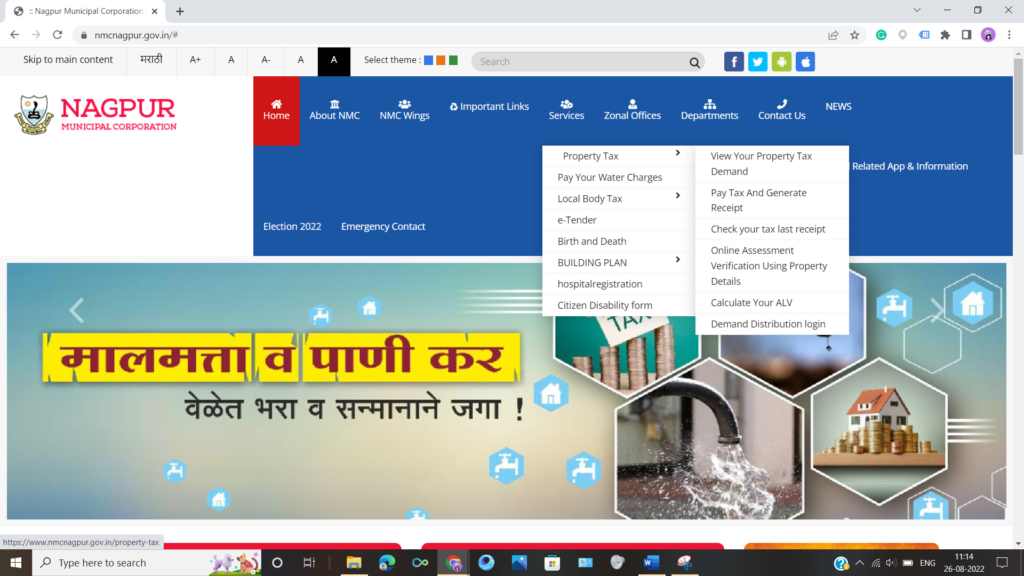

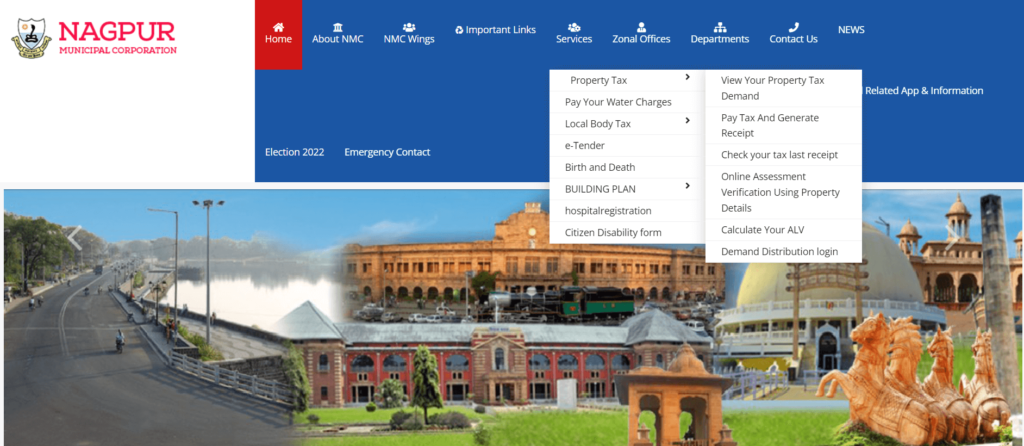

- Visit the official Nagpur Municipal Corporation (NMC) website.

- Find out the “Service” tab and scroll down for Property tax.

- Click on the Property Tax option, and you will land on a new Pay Tax and Generate Receipt page.

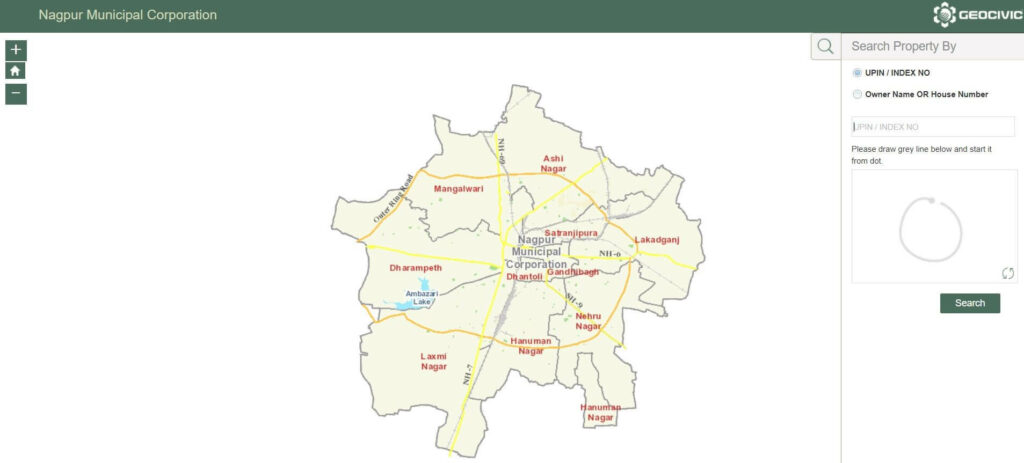

- Enter your index number in the tabs and click on Search.

- If you have entered the correct number, all the details, including your name, contact number, address, and property-related information, will be visible on your screen.

- Click on the Action button on the right-hand side of the page to find the details of property tax and due amount.

- It will provide you with an option to waive your dues in full or partial amounts.

- Select your feasible option and opt for an online payment mode (UPI, Internet Banking, or Credit Card) to complete the payment.

- Once done, print the receipt and save it for future clarifications.

Note: To lessen the financial burden and encourage landowners to pay property tax, NMC has announced around a 5% rebate on full payments. If you wish to redeem the rebate benefits, click on the full payment option for your property tax.

Offline Payment Procedure for 2023 Nagpur Property Tax:

For people who are not very friendly with digital portals and have security issues, the offline property tax payment option will help you redeem the rebate benefits. You can visit the Municipal Ward Office, authorized bank branches or Citizen Facilitation Centres to wave off your fiscal year dues.

- Plan your visit to the nearby ward office and check whether it is meant for your property type or not.

- Submit your assigned account number and ask for documents from the authority.

- Use receptive challan to remit the ward office counter fee.

- Once your account is verified and records are fetched, you can pay the amount to the authority.

- Collect your receipt for payment and fees remitted for records.

Exemptional Cases or Concessions 2023:

There are some properties that NMC exempts from property tax. These include-

- Properties less than 500sq ft,

- Agricultural properties,

- Properties owned by Union Government, State Government, and Corporation,

- Properties used for Educational Purposes like hostels, schools, libraries, boarding houses, and others,

- Properties or buildings used for charity, public worship, as a cremation ground or public burial,

- Properties owned by disabled employees or officers.

- Property Owned by political parties.

Recent Nagpur Property Tax Rebates:

On July 1, 2022, NMC announced a 5% rebate on full property tax payments done before the due date. More than 50,000 taxpayers have benefitted from this rebate ranging from 5% to 10% in 2022 between April to June.

From a recent data fetched for 2022 Nagpur Property Tax collection, more than 79,000 landowners have paid their whole debt of around 32 crores and have received a 10% rebate, accumulating about 22.56 crore. Similarly, more than 1.5 lakhs owners received a 5% rebate, reimbursing around 21.9 crores on a total collection of 54.8 crores.

These figures show that tax payments can help relieve land owners’ substantial financial burden before the due date. This rebate is furthermore given on entire property tax, excluding-

- Employment guarantee cess

- Education tax od state government.

Moreover, if you have implemented any of the mentioned government schemes in your project, then you will be eligible for an additional 10% discount-

- Rainwater harvesting,

- Decompose waste,

- Solar Rooftop System,

- Reuse or recycle rainwater.

Frequently Asked Questions

How do I find my Property Tax Index Number?

If you face any log-in or index number issues while paying your property tax online, contact the municipal office of your area for extended help.

What is a Geo-fencing System?

The government has recently introduced the geo-fencing system for 10 zone tax recovers where the colour for full paid tax properties will turn green, and for partially paid taxes, it will turn saffron. The properties still haven’t paid anything and owe to the government will be marked red.