MCD Property Tax | Property Tax | Online Payment | Calculation | Jurisdiction | Property ID | Without a Property ID | Municipal Corporations | Exempt | Offline | Certificate | Latest news | Rebate on Property Tax Delhi |

Every year, homeowners must pay property tax. The amount of tax, on the other hand, varies depending on where you live. This is a guide on paying property taxes in Delhi. Discover the MCD property tax due dates for 2020-21 and information about how to spend your MCD property tax for 2021-22.

The municipality in charge of maintaining the city’s infrastructure is called the Municipal Corporation of Delhi (MCD). The MCD imposes various taxes and fees on Delhi citizens to raise the money necessary for its operations. The property tax is one such tax and a source of income for a municipal corporation. The tax known as real estate taxes in Delhi is imposed on real estate there. Regardless of the kind of property or its occupancy, owners are required to pay property taxes annually.

There are three jurisdictions within the Delhi municipality. The municipality corresponding to the division under which the property falls is responsible for collecting the property tax. A specific formula is used to determine the property tax for the New Delhi Municipal Corporation. The MCD sets the tax rate, which is also examined yearly. Get all the information about Delhi’s property tax by reading on.

What is MCD Property Tax?

Municipal Corporation of Delhi The Municipality of Delhi, or MCD, collects people’s property taxes. The MCD will establish a deadline for the annual tax collection. The MCD website also offers a simple method for making payments.

Owners of residential real estate in the capital city must pay property taxes to the city’s municipal corporation. The MCD property tax will be assessed on any real estate, including abandoned properties, that is under the body’s jurisdiction.

Property Tax in Delhi: An Overview

All properties under the control of the Municipal Corporation of Delhi, or MCD, are subject to taxation. All real estate, including unoccupied land and structures, are subject to this tax.

As a result, all property owners, whether they own their home or business, are responsible for paying MCD property tax.

MCD Property Tax Internet Payment, How and where to Pay Delhi Property Tax

We can advise if you are presently or plan to pay MCD property taxes online. Here are a few easy steps you may take to deliver your Delhi property tax.

MCD is divided into North Delhi Municipal Corporation, South Delhi Municipal Corporation, and East Delhi Municipal Corporation. The goal is to share the burden among the three departments that serve the various regions of the city. Furthermore, this will simplify and improve MCD property tax payment operations for both users and the department.

The North Delhi Municipal Corporation governs Karol Bagh, Sadar Paharganj, Civil Lines, Nartela, and Rohini. The South Delhi Municipal Corporation has authority over Central Delhi, South Delhi, West Delhi, & Najafgarh. East Delhi Municipal Corporation is in charge of Shahdara south and north.

Calculation of MCD Property Tax

The Municipal Corporation of Delhi uses the Unit Area System to determine MCD property taxes.

Additionally, it uses a formula to determine how much tax real estate owners must pay.

Check out the following formula:

Annual Value x Tax Rate = Property Tax

Confused? Do not worry; we will explain this to you:

1) Annual Value – MCD uses the following calculation to determine a property’s annual value:

Property Tax = Structure Factor x Unit Are a Price per Square Meter Age factor x The property’s covered area x apply factor x x flat element The occupancy rate.

Please allow us to provide you with a greater understanding of this equation by exploring each of the elements above:

The unit area price per square meter might vary depending on the property type. To find out more about this, keep reading.

- Structural factor: It is dependent on how a property was built.

- Age factor: It ranges from 0.5 to 1 on a scale. In Delhi, newer homes are subject to more outstanding taxes than older ones.

- The term “covered area of property” refers to a building’s whole floor space.

- Use factor: MCD determines this factor depending on how a property is used.

- Flat factor: It is based on the whole area that a flat covers.

- The occupancy of a property is considered, including whether it is rented out or used by the owner for personal use.

Find out your Jurisdiction

The jurisdiction where your property is located is the first thing you need to know to file property taxes in Delhi. Visit mcdpropertytax. in or mcdonline.gov.in, the Municipal Corporation of Delhi’s (MCD) official websites, to accomplish it.

It would help if you decided which zone the property is located in based on your area. Click “Zone List” or “Bacterial colonies List” under General Information in the main navigation to verify that your chosen jurisdiction is yours. By doing so, you may check to see if your area or colony is included here. Additionally, confirm if your site or settlement is included on the Metro City Centres (MCC) listing or the General list, as the rates for property taxes in these categories vary.

Pay Property Tax in Delhi Online

The MCD enables you to pay Delhi house tax online from your home or place of business. The steps for paying taxes online are as follows:

- Go to the MCD’s service site and choose “Property Tax (PTR).”

- Two possibilities exist: You may access your account to make a payment or examine your previous land tax receipts and records.

- To make a payment, select “Taxpayer Login.”

- You would need to log into your account in a new window that would appear to pay the real estate taxes. If this is your first time spending the tax, you need the first register as a new user before proceeding with the payment.

- You can log in using your registered cellphone number, and an OTP received there after signing up or if you are already a user. You can also log in using your login information.

- Click “Pay Tax” to submit your online property tax payment if you already pay taxes.

- You would need to search the property using the old data if you were a new user, after which you would need to pay taxes on it.

- You require a Universal Property Identification Code (UPIC) to pay property taxes. A 15-digit alphanumeric identifier identifies your property called the UPIC.

- Choose the property & pay the appropriate property tax once the processes have been completed. Online payments can be made using debit and credit cards and net banking.

- After paying Delhi property tax online, you may generate a challan and obtain the Delhi property tax rebate for the amount you paid.

Pay Property Tax in Delhi Offline

Delhi has an offline property tax payment option as well. You may make this payment at one of Delhi’s ITZ cash kiosks. Provide the ITZ counter with the information about your property, and they will assist you in paying the tax. Once the tax is paid, a receipt for Delhi’s property taxes that includes the property’s tax ID is immediately generated. Keep a copy of the receipt and the ID number for your records. Be aware that the Delhi real estate tax receipt download feature is not accessible in cases of offline payments.

Find Your Property ID

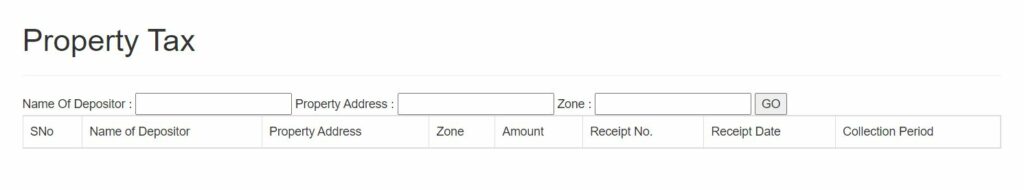

You must input your Property ID to get property data from the previous PTR to file an online property tax return for 2022–2023. Your prior Property Tax Challan or Property Tax Receipts will contain the Property ID. You can still file a property tax return even if you weren’t previously given a Property ID. The bottom button should be clicked. The picture underneath

You may also look up your property ID for online property tax payments in Delhi. The List of Properties IDs link in the main navigation should be clicked. You must enter your community name, choose the kind of property, enter the property owner’s name, OR enter the name of a company, farm, trust, board, institution, government agency, or HUF, and then click “Submit Image” on the page that appears.

Visit www.mcdpropertytax.in or mcdonline.gov.in, the formal MCD property tax payment websites, to begin Delhi’s property tax payment procedure.

South Delhi Municipality, North Delhi Municipal Corporation, and Lok Sabha constituency Municipal Corporation are your options for authority.

View and agree to the conditions on the following page. Examine the package first. “I have read and agree to the preceding Terms & Conditions.”

Select the “button by clicking it.

To file your 2022–23 property taxes, go here.

Enter your property ID, a one-of-a-kind identifying number provided per each property in Delhi by the MCD, and then click submit on the next screen.

An entire page of the Property Tax Return 2022–23 form opens.

How to Pay Property Tax Without a Property ID Online

As previously noted, you need your 15-digit unique property ID to pay your Delhi property tax online. You may still pay monthly real estate taxes in Delhi even if you don’t have a property ID. Only one more step would be required to produce the UPIC.

On the service side of the MCD, you may generate the UPIC online. Through the site, submit an online application for UPIC and create the 15-digit code. After you have this code, filing your Delhi home tax is simple.

On the Property Tax Return Form 2022-23, you need to give the following details:

- Ownership Information, including Type of Ownership and Type of Property Owner Name and Information, including Gender, Age, Occupants, and Type of Rebate Information, including Colony, Address, and Property/House No.

- Phone number and email address of the owner of the property (Not Mandatory)

- Bank information for the property owner, such as account numbers, banks, and branches (Not Mandatory)

- Building information and tax calculations, including the number of floors, covered area in square meters, use factor, structural factor, occupation factor, year of construction, and whether the property falls under any exemption categories

- Read my Declaration and check the box to indicate that you have done so. Before submitting, we advise you to double-check all the information you have entered.

- Hit “Submit.”

List of Municipal Corporations in Delhi

There are three major municipal corporations in Delhi:

- Metropolitan East Delhi Corporation (EDMC)

- Delhi Municipal Corporation, North (NDMC)

- Delhi Municipal Corporation of South (SDMC)

Properties Exempted from MCD Property Tax

There are several exceptions to the need for property owners in Delhi to pay property tax on all types of properties. The properties listed below are exempt from paying property taxes:

- Property belonging to people who lost their lives while performing police or paramilitary duties.

- Vacant buildings are utilized as charity, public cemeteries, heritage sites, or a house of worship.

- Any form of structure or land used for agriculture, except homes.

- Property held by a Gallantry Award winner or war widow solely used for self-residence.

- Owned property by a sportswoman who has won a prize at a major competition.

- Property held by a disabled or disadvantaged South MCD employee

How to pay your MCD house tax in Delhi offline?

By contacting any 800 ITZ money stations spread around Delhi, property owners can now pay their home tax using an offline approach. The taxpayer will receive an immediate MCD home tax receipt after paying the property tax. The ticket will include the property tax ID, which may be stored for future use in paying property taxes.

Property tax payment through MCD online app

Amid the coronavirus outbreak, the South Delhi Municipal Corporation (SDMC) introduced a smartphone in May 2021 to make it simpler for homeowners to pay their MCD property taxes online. The app was designed for three municipality corporations: the NDMC, SDMC, and EDMC.

To download the app, go to the MCD website.

Choose “internet services.” You will be sent to a website with connections to various online services.

Click on the Mobile App tab.

To understand how to install and utilize the mobile application, consult the user manual.

MCD birth and death certificate online

The MCD website accepts applications for birth and death registration from citizens. According to the Registration of Birth Act, 1969, residents of Delhi are required to record every birth. In Delhi, a person can prove their identity and age with their MCD birth certificate. It is distributed by the Delhi government’s Chief Registrar of Births.

Through the online birth and death registration form on the Delhi Government website. Additionally, you can access the MCD property tax site to obtain online access to MCD death and birth certificates.

- Select your municipal organization from the list of alternatives when you get to the portal. Click on the EDMC page to apply for an EDMC birth cert or EDMC death certificate.

- Select the option for Birth and Death Registration. Use the Citizen Login option to log in. If any, the account will also include information on earlier birth/death registration records. The bottom will have links for birth registration, stillbirth registration, death registration, and looking through historical data.

- Select from the choices provided for birth, death, etc., registration.

- Apply with the required information. Upload any evidence of the required documents.

- After receiving clearance from the SubRegistrar/Registrar of the relevant zone, the certification will be created.

Latest news for MCD property taxpayers

MCD extends the property tax deadline in Delhi. The MCD has delayed the property tax payment deadline to July 31, 2022. The refund for the upfront fee for the fiscal year 2022–2023 will be 10%, by the new regulations, instead of 15%.

The revised tax rates issued by the local government on July 7, 2022, took effect on July 16, 2022, to guarantee consistency in the tax bracket rates for residential, industrial, industrial, and properties in those other categories.

Forty thousand property owners receive notifications from MCD regarding property taxes.

MCD has sent almost 40,000 letters to households whose tax documents for a fiscal year or their property tax payment receipts are not accessible to the civic authority to update property tax records and follow individuals who do not pay the property taxes.

Since 2004, few citizens have been required to provide information about their tax payments. According to the officials, residents may submit the documents online by email or a WhatsApp number. According to the civic organization, this activity strives to guarantee system transparency.

MCD extends the property tax filing deadline to July 15

The MCD has delayed the June 30 deadline for submitting property taxes in Delhi again for fiscal years 2022–2023 to July 15. Taxpayers can still use the 15% property tax refund during this period by paying their taxes all at once. In addition to the refunds offered to women and older adults who are property taxes, there is also this rebate. Those property taxes that could not use the refunds would benefit from this action.

In FY 2021–2022, SDMC records the most excellent MCD property tax collection.

In a recent announcement, SDMC claimed that in FY 2021–2022, it had earned the highest median tax collection of Rs 1,081 crore. It generated revenue of Rs 943 crore the year before. According to authorities, many properties in the city have not yet been included in the tax system. However, this year’s property tax filings totaled close to 4.65 lakh people.

The civic body claimed that one of the factors that contributed to the rise in property tax was the authority’s effort to simplify and make the tax payment service more user-friendly by moving the entire procedure online and encouraging individuals to pay their back taxes online.

SDMC extends the date for MCD property tax payments.

The SDMC has agreed to continue the cutoff date for its amnesty plan 2021-2022 to January 31, 2022, to reimburse real estate taxes with a 100% tax and penalty remission. The MCD property tax system 2021-22 has been adjusted to assist taxpayers experiencing difficulties due to COVID-19 lockdowns and limits.

Following the modifications, taxpayers can get waivers of 90% of tax and 100% of penalties if they settle the outstanding MCD tax debt by February 28, 2022, and 80% of interests and 100% of punishments if they pay the balance by March 31.

SDMC launches amnesty property tax scheme for city’s unauthorized colonies

On October 29, 2021, the South Delhi Municipality (SDMC) established an amnesty program to assist property owners who cannot repay their debts owing to fines, interest, and financial constraints. The program will run through March 31, 2022. It will apply to all approved colonies (excluding affluent unapproved settlements like Lal Dora village), the increasing number of inhabitants of these villages, and the properties handed to Kashmiri migrants by the government. Owners of existing residences can pay a year’s property tax value under this arrangement. In contrast, owners of virtual properties may spend three years’ property tax value instead of their previous property responsibilities.

In other words, residential property owners will not be responsible for paying property taxes from FY 2021–2022, provided they paid MCD property taxes in 2021–2022. Similarly, non-residential property owners who pay tax for 2019 – 2020, 2020 – 2021, and 2021 – 2022 will not be required to pay property tax before FY 2019-2020.

North MCD announces partial rollback of last year’s property tax hike.

The North Delhi Municipal had decided to partially reverse the property tax hike adopted in 2020 regarding the third city value committee (MVC) report. The central committee approved this concept. The tax-exempt categories are abandoned property, non-residential rental units, or commercial and industrial (empty) land. According to the instruction, Americans who have already filed their taxes will not be refunded.

Unique ID code required to register east Delhi properties

The Unique Property Identification Code (UPIC) registration must be obtained from the EDMC before registering property in east Delhi with Revenue Department. To make all property information available online, the civic body intends to include UPIC among the paperwork required for property registration. The Delhi administration gave the go-ahead to test the EDMC concept first. The UPIC is also necessary for property registration, obtaining licenses, and rent agreements established through the Tax Authority.

North MCD allows property tax waivers to Lal Dora residents.

To assist the people of Lal Dora, extend Lal Dora (ELD), and extend Abadi of the hamlet, the North Delhi Municipal Corporation has unveiled a new amnesty program. The program has also been expanded to 544 illegal regularised colonies, illegal colonies, and properties given to migrants from Kashmir.

Residential properties built before the current fiscal year 2021–22 and non-residential assets made before the fiscal year 2019–20 will get relief through a property tax waiver. Owners of existing homes in these colonies are required under the plan to pay real estate taxes for the current fiscal year 2021–2022. Before the latest fiscal year, all unpaid property tax obligations have been canceled.

Rebate on Property Tax in Delhi

You can apply for a refund on land tax payments to reduce your tax obligation in Delhi. When paying Delhi residence taxes, the following situations are eligible for a rebate:

- One property with a maximum square footage of 200 meters may qualify for a 30% refund as long as it is occupied by former service members, senior citizens, women, or people with physical disabilities.

- If you repay the real estate taxes in full before the end of the fiscal year, you are eligible for a 15% discount.

- 10% off the yearly value of CGHS and DDA apartments with a maximum square footage of 100 meters is permitted.

- The following extra requirements must be met to qualify for these rebates:

- The building must be utilized for residential purposes or as self-contained housing.

- The refund will be distributed based on each owner’s ownership interest if the building is partly owned.

Conclusion:

You must pay MCD property tax on any property you own in Delhi. The tax is determined by your property’s kind, location, and other variables. Therefore, to fulfill your federal obligation, grasp what property tax is, how to calculate it, and how to pay it off.