Paying NMMC Property Tax | Ledger | Current Bill | Online Payment | Alerts | Tax Exemptions | Property Details | Tax Calculator | Non-Payment | Grievance Redressal | Wealth Tax | Property Tax | Contact Details | FAQs

How many taxes do you pay for yourself and your family?

There must be some compelling reasons to charge a property tax!

You own property to live peacefully. Many senior citizens rent their second homes to earn a livelihood and live independently. The high property tax in Mumbai cautioned the property buyers. They explored different affordable options in Navi Mumbai, the satellite city of Mumbai.

We’ve made paying your property tax easy. Just follow the steps.

The serene and lush green landscape in Navi Mumbai always attracts property buyers.

The Navi Mumbai Municipal Corporation (NMMC) maintains and manages the civic work in its jurisdiction to provide better facilities and infrastructure to its inhabitants. NMMC does all these arduous tasks with the revenue generated from the NMMC Property Tax every year.

“The jurisdiction of NMMC starts at Digha in the north and ends at Belapur in the south. NMMC area has been divided into nine zones sprawling in 162.5 sq km. These are Belapur, Nerul, Turbhe, Vashi, Koparkhairane, Ghansoli, Airoli, Digha, and Dahisar. Central Business District (CBD) is the heart of Navi Mumbai.” Courtesy https://www.nmmc.gov.in/zoning

Don’t worry about paying your property tax. You will find the following easy ways handy to deal with and know more about NMMC Property Tax.

Also, read our ultimate guide on paying Navi Mumbai water bill.

How to make NMMC Property Tax Payment

Make your Property Tax Payment hassle-free with the following steps.

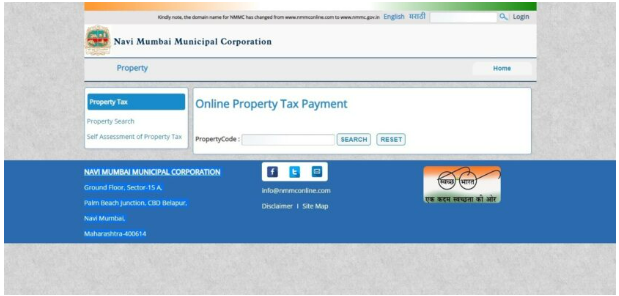

- Log on to https://www.nmmc.gov.in/property-tax2

- Enter your property code

- Press the SEARCH tab

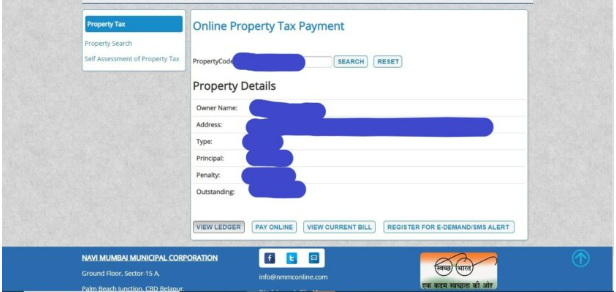

Now, you land on the next page showing the following details:

- Owner’s Name

- Address

- Type Of Property

- Principal Amount

- Penalty (If Any)

- Amount Due

View NMMC Wealth Tax Ledger

Click on the ‘View Ledger’ tab (extreme left, in the Online Property Tax Payment box) to view NMMC Wealth Tax Ledger details.

You get a detailed page, as shown below, that contains all your ledger details.

NMMC Property Tax Bill: How to View Current Bill

To view the current NMMC Property Tax Bill

Click on the ‘View Current Bill’ tab.

Fill in your details and follow the steps to view the current bill.

NMMC property tax online payment

Are you afraid of making online property tax payments?

People fear compromising their property details through online services.

Don’t worry. We will walk you through the steps to pay your property tax securely and hassle-free.

A big NO to public networks while making any kind of online financial transaction, though. Avoid that and use a trusted and safe network to make online payments.

- Go to https://www.nmmc.gov.in/property-tax2

- Enter your property code and other details.

- Click on the ‘Pay Online” tab next to the ‘View Ledger’ tab.

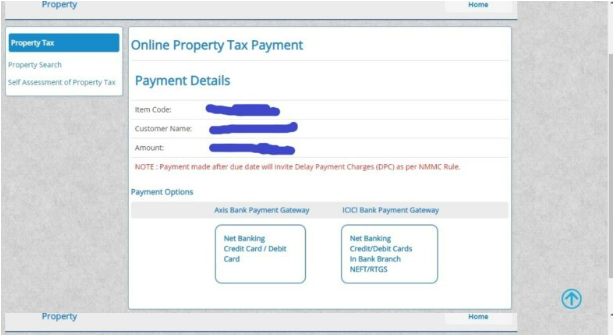

- Enter the Item Code, Customer Name and Amount when it takes you to the next page.

- Pay by using Net Banking, NEFT/RTGS, Credit Card, or Debit Card

- Note the Transaction Reference Number

- Print or Save the Challan

Note: Make your NMMC property tax payment before the due date to avoid the ‘Delay Payment Charges (DPC).

Note: Pay the entire dues relating to NMMC property tax before you make any alterations, donate or pledge your property. It’s illegal and prohibited to engage in such acts.

Always invest in a property that doesn’t have any property tax due.

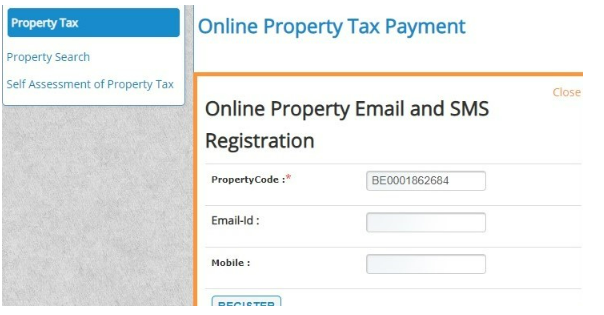

NMMC Property Tax: How to register for e-demand/SMS alerts

- Click on ‘Register for E-demand/SMS alerts.’

- A pop-up box appears.

- Fill in the following details:

- Property Code, email id and mobile number.

- Hit Register

- Follow the further steps to confirm with your OTP.

You’re done!

NMMC Property Tax Exemption

What’s the amnesty scheme for NMMC Property Tax?

The coronavirus pandemic drastically reduced the NMMC property tax revenue. Instead of collecting INR3000 crore as property tax for this year, it received around INR1077 crore.

The authority issued confiscation notices to the defaulters. They are yet to pay their property tax.

To reduce the penalty burden and encourage property owners to pay their property tax, NMMC introduced the ‘Abhay Yojana’ or Amnesty Scheme to recover its revenue from the remaining property tax payments.

Abhijit Bangar, Municipal Corporation Commissioner, Navi Mumbai, shared the ‘Abhay Yojana’ details. The government reduced the penalty levied on the non-payment of the property tax. The property owners can make the pending tax payment only with a 25% penalty. It’s a rebate of 75% on the penalty for late payment.

“The Navi Mumbai Municipal Corporation (NMMC) has extended the amnesty scheme for property tax holders till February 28; the scheme was to expire on January 31”.

HT Feb 04, 2022.

Paying NMMC Property Tax: How to Find Property Details

To find details about the property, follow the steps below:

Click on ‘Property Search’ on the NMMC Property Tax link or visit https://www.nmmc.gov.in/property-search

Enter the following details:

- Ward

- Sector

- Plot

- Building

- Owner’s First Name

- Owner’s Last Name

Click on ‘Search’.

You will get all the property details, including the property code.

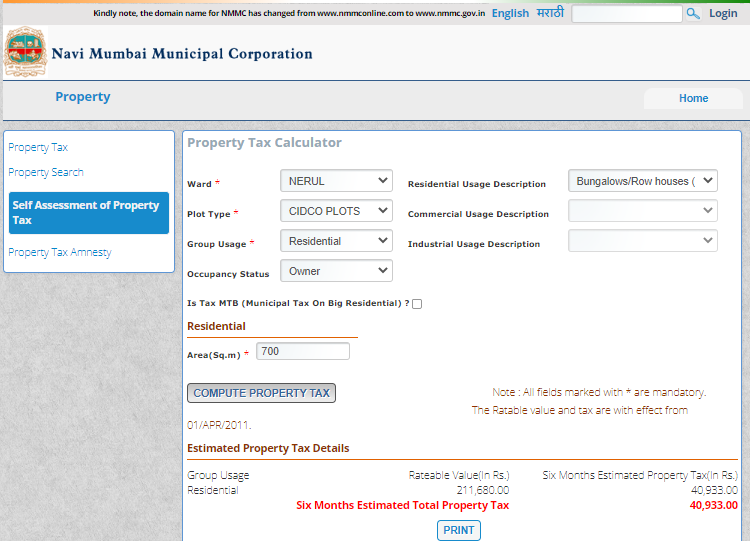

NMMC Property Tax Calculator

This free application helps you compute your property tax. The following points decide to calculate the tax amount.

NMMC property tax is levied on a fixed percentage of the property’s rateable value (land and building).

Rule 7 of the Taxation Rules, Chapter-VIII appended to the MMC Act, 1949, lays down how the rateable value of land and building is to be determined.

“For fixing the rateable value of any building or land set to property tax, shall be deducted from the amount of annual rent for which such land or building may be expected to be let out on a year-to-year basis.

An equal amount up to 10% of the said annual rent and the said deduction shall be instead of all allowances for repairs or on any other account, says Rule 7.

To make it simple, you can calculate your property tax on the rateable value as per the following:

- Type of construction

- Use of the property

- Rent on the property

- Additions made to the property

The rates are 38.67% for residential and 68.33% for both commercial and industrial properties.

Calculate the NMMC property tax of your property on Self Assessment of Property Tax – NMMC

Enter the following details (as applicable).

- Ward

- Type of Plot

- Group Usage

- Occupancy Status

- Residential Usage Description

- Commercial Usage Description

- Industrial Usage Description

- Check or uncheck ‘Tax MTB?’ (as applicable)

- Hit the ‘Compute Property Tax’ tab.

See the illustration below.

What happens if you do not pay NMMC property tax on time?

Are you afraid of not making your NMMC property tax payment on time?

NMMC may take strict action apart from the ‘Delay Payment Charges (DPC)’ if you fail to make the property tax within the given time. They may send a notice for confiscation of your property.

We help our connections to make the property tax payment on time. Follow along the steps to make your property tax payment online and live peacefully.

NMMC Property Tax Grievance Redressal

Don’t panic if you get any unwanted or huge bills because of some errors. You may lodge your complaint about your NMMC property tax online easily.

Follow the steps below:

- Use your Email and Password to Sign in on https://www.nmmc.gov.in/

- Register the complaint.

- Track it.

- Give your feedback.

Go through Grievance_(1).pdf for more details.

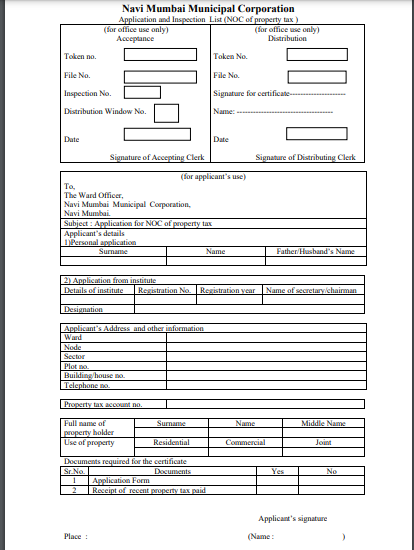

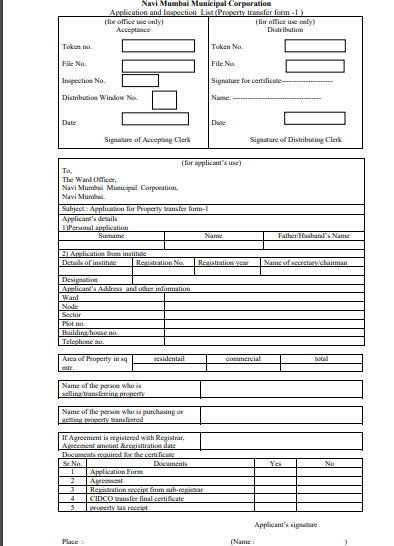

Other Services under NMMC Wealth Tax

We’ve curated a list of documents for other services under NMMC Wealth Tax for you.

Visit the Citizen Facilitation Center Form to Access the following forms:

- Property Tax NOC

- Property Transfer Form No. 1

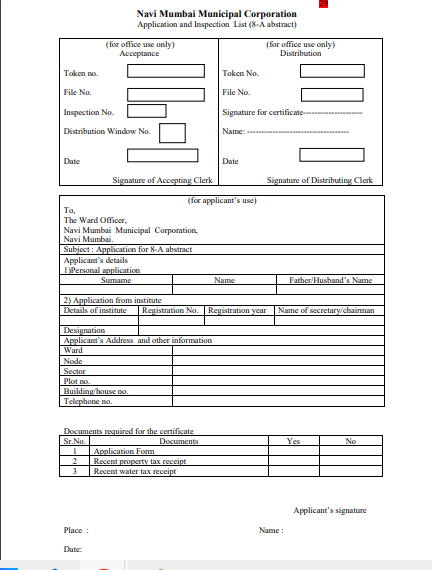

- 8-A Abstract on the NMMC website by clicking or by logging on to

Click on NMMC Property Tax NOC to get the form as shown below.

Click on Asset Transfer Form No. 1 for property transfer.

Click on 8-A Abstract to access the form.

Important things to know about your Paying NMMC Property Tax

You can avail of all the information about your property tax on the government website.

Choose to make an online or offline payment.

Ensure to make the property tax payment before the due date that falls in February every year (Financial Year-FY). For the year 2022-23, the payment date will be in February 2023.

NMMC Property Tax Contact Details

Navi Mumbai Municipal Corporation Ground Floor, Sector-15A, Palm Beach Junction, CBD Belapur, Navi Mumbai, Maharashtra-400614

Frequently Asked Questions (FAQs)

Which corporation governs NMMC property tax?

Navi Mumbai Municipal Corporation governs NMMC property tax.

What are the benefits of paying NMMC property tax online?

It provides peace of mind while also saving time and effort.