AMC property tax | calculation | online bill payment | Property Tax | tangible asset | paid online | refundable | Vitality | Summary

Property tax is an annual tax levied by local governments. This tax is paid on tangible real estate owned by individuals, such as houses, buildings, offices, and premises rented to others. In Ahmedabad, property tax is a requirement for all property owners.

There are two ways to pay the tax: online or in person. You must first pay the tax before you can take possession of your property.

What is AMC property tax?

Proprietors of properties or plots in Ahmedabad, are at risk to pay AMC property tax to the Amdavad Municipal Corporation (AMC) consistently. The AMC property tax has one of the easier to use.

It is a mechanically progressed property tax installment framework for the metropolitan tax bills in the nation and this is obvious from the way that Ahmedabad civil organization property tax bill installments have expanded altogether.

AMC is answerable for upholding changes at the Ahmedabad metropolitan tax and having a zero prosecution record.

AMC has sent off prompt riser motivation plans for citizens paying their Ahmedabad metropolitan organization property tax bill on time. People paying the property tax in Ahmedabad between April 22 to May 21, 2022, would get a 10% refund.

Those who make AMC tax installments between May 22 to June 21, 2022, would get a 9% refund, and citizens covering AMC property tax bills between June 22 to July 21, 2022, will get a discount of 8%.

Taxpayers making AMC online property tax installments will get an extra 1% discount on Ahmedabad civil enterprise property tax bills across every one of the openings.

The Ahmedabad Municipal Corporation is one of only a handful of exceptional metropolitan bodies in the country that empowers its citizens to pay their Ahmedabad Municipal Corporation property tax levy through its ‘Ahmedabad AMC‘ application.

You can likewise pay the Ahmedabad Municipal Corporation property tax at https://ahmedabadcity.gov.in/gateway/index.jsp.

AMC property tax: How to calculate?

The AMC property tax is determined on a property in view of its capital worth. This arrangement of computation has been active beginning around 2001 and thinks about the accompanying elements – an area of the property, sort of property, period of the property, and its utilization in Ahmedabad.

The process for manual estimation of AMC property tax is as per the following:

AMC Property tax = Area x Rate x (f1 x f2 x f3 x f4 x fn)

Where,

f1 = weightage given to the area of the property

f2 = weightage given to the kind of property

f3 = weightage given to the age of the property

f4 = weight relegated to private structures

fn = weight allotted to the client of the property

The qualities connected to every one of the above loads are accessible on the AMC’s site Ahmedabad civil organization property tax site.

AMC property tax bill payment online

This is likewise the quickest method for paying your AMC property tax to the Ahmedabad civil partnership. AMC online property tax can be paid at www.ahmedabadcity.gov.in. You can go about property tax payments online through the ‘Ahmedabad AMC’ portable android application.

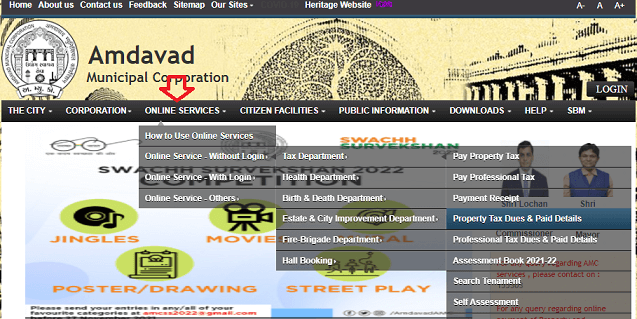

- On www.ahmedabadcity.gov.in, under web-based administrations, pick online help without login, tax division, and click on pay property tax to continue with AMC property tax bill installment on the web.

- Click on Online Service – Quick Pay – Pay AMC Property Tax.

- Enter your ‘Apartment Number’ and snap on search on the Ahmedabad metropolitan partnership property tax site at www.ahmedabadcity.gov.in. You will be shown the subtleties for the Ahmedabad civil company property tax bill like the name of the proprietor, address, occupier (if any), and the sum that you owe as property tax.

- Click on the ‘pay’ symbol for paying the sum. You will be diverted to another page, showing the apartment subtleties and the sum to be paid. There will be fields requiring your portable number and email.

- Click on ‘confirm’ to continue to the installment passage. In the event that you are making the installment on the web or through the application, you can utilize web banking or your charge/Visa.

Property tax in Ahmedabad

Property tax in India is a part of the taxation system. This is a type of tax based on the assessed value of a house and is set by the municipality. However, it is important to note that there are exemptions for certain classes of property.

Some of these are listed below. You can also look up the exemptions by city or state on the Department of Revenue website. Once you know which tax to pay, the next step is to understand your property tax bill.

The taxation system in India is complex. Property tax is a component of the income tax system. This also applies to residential and non-residential land, private roads, gardens, parks, and other legal entities.

How is it collected?

Taxes are collected annually from taxpayers whose ownership of property is on the first day of the tax period. It can be shared with the buyer of a property. In addition to the above, property tax is applicable on a per-square meter basis, which means that you must have a minimum amount of space available to rent the property.

The revenue generated from property tax is primarily used to fund municipal services. It is estimated that property tax revenue in India is just 0.2 percent of the national gross domestic product – far below the average in the OECD.

Moreover, many states in India collect a very small amount compared to their counterparts in the OECD group. This is primarily due to undervaluation, incomplete registers, and ineffective administration.

The income generated from property taxation depends on the value of the property and the annual rental value. Currently, the taxation of non-owner-occupied property is governed by section 83 of the Indian Act.

However, the Act does not provide the Indian taxation system with expanded tax powers, such as the ability to collect service taxes, development cost charges, and debenture financing.

While there is no standardized definition of rentable, property tax is a major component of the Indian taxation system.

Ahmedabad Property Tax: Tangible asset

If you own property in Ahmedabad, you will need to pay property tax. Property tax is a government-mandated tax that is applied to any tangible asset. In Ahmedabad, property tax is collected half-yearly and must be paid by the 15th of March and the 31st of October.

The exact dates are not fixed and can change depending on AMC decisions. In 2013, the last payment date for the second half of the year was the 31st of December.

It is important to note that your check must be drawn in the name of the Municipal Commissioner and that any defaults and late payments will be penalized by 2% per month. Generally, these penalty amounts are added to the next bill.

Taxpayers in Ahmedabad must pay the appropriate amount of property tax for their property. This tax is calculated on the basis of a formula notified by the state.

The amount is calculated on the basis of the property’s value and location. If you are selling your property, you will need to include a receipt showing that you paid the tax on time. This receipt is proof of due diligence when selling the property.

Online Payment

AMC has introduced a mobile application to enable citizens to pay property tax online. The number of online transactions increased by 25 times as compared to last year, while cash payments decreased by 8 percent.

The AMC has set the goal to make all services offered online and encourages citizens to use it to pay property tax. For more information, visit the AMC website or download the mobile app. In addition, online payment helps the AMC reach its target of making transactions as smooth as possible.

Property tax is collected twice a year, on March 31 and October 15. If you are unable to pay your bill on time, you will incur a 2% penalty per month. The good news is that there are a variety of discounts available to you.

Most of these discounts will be available to you based on the due date. The AMC has never been lacking in revenue generation. You can even receive an instant rebate if you pay your property tax on time.

Precautions

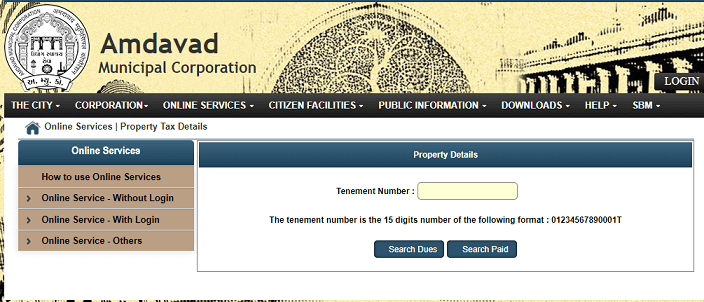

Before making payments, you should prepare your Property Account Number and other relevant information. You will need to have the property’s tenement number, owner’s name, and address.

You can use this number to cross-check details in your Property Tax Bill with those on your portal. The ward office will correct any deviations and you can track payments made offline. You can also use the Property Tax Portal to track outstanding dues and make payments.

The easiest and quickest way to pay your property tax is to make it online. You can do this any time of the day, from the comfort of your home. It is fast and simple to do, and you can pay the tax from anywhere in the world.

The best part about paying property tax online is that it’s free. And you can access the portal from your smartphone or a home PC.

Refundability

The AMC has issued an advance refund scheme for Ahmedabad residents who pay their property tax before July 30, 2021. If they pay before this date, they will get a 10% discount on their AMC tax.

If they do not pay before this date, they will be charged penalty interest as well as interest on the amount they overpaid. AMC also extended the advance refund plot cutoff date to July 30, 2021, so that residents who pay before this date can claim an additional 10% rebate on their tax.

Time-Frame

The AMC collects property taxes half-yearly in Ahmedabad. This means that you should pay before the 15th of October and the 31st of March, respectively. These dates are not fixed and can change as per the AMC’s discretion.

For example, the last date for the second half of the year in 2013 was 31 December. AMC also charges a penalty of 2% per month for late payments and defaults. In most cases, this amount is added to the next bill.

If you want to pay online, you can download the assessment book from the AMC website. You can also find it in the tax department section of the AMC website. Simply visit the AMC website and look for the assessment book, or download it as a PDF file.

To download your assessment book, all you need is an email address and your full name, as well as a mobile number. After that, you can fill out the form online. You will also need to enter your tenement number, electricity service number, and the name of the owner.

Once you have completed all of the steps to submit your ITR, you can wait for the refund to reach your account. If you are paying by credit card, the AMC will debit your credit or debit card account immediately.

You will receive an e-mail or a receipt for the payment. In some cases, the tax refund can be as much as 15%. To ensure that you get the full refund, be sure to pay in full this year.

AMC and The Indian Taxation System

In India, the system of taxation is based on the unit area value of a property. This means that the tax is fixed per square foot of built-up area.

There are three main ways to calculate the property tax for an individual: per square foot monthly, per month for commercial properties, and per square foot for residential properties.

Each method has its own requirements and rules, but the basic principle is the same: the amount is multiplied by the built-up area of the property.

The payment of property tax can be done either in person at the municipal corporation office or through designated banks affiliated with the MC. It is important to note that the tax amount is due in advance, and late payments can incur interest and penalties.

In addition to penalties, the property tax liability falls on the landowner, and can even result in the confiscation of their property. Historically, property tax records were kept in handwritten registers, but this has changed.

Summary

Today, many cities have online payment portals for paying property tax. In rural areas, a few municipalities still rely on manual registration of details in registers.

Payment of property tax is made twice a year. On the first day of March, the bill is due; the second is due by the 15th of October. These dates are not fixed and can change depending on AMC decisions.

In 2013, the last payment date for the second half of the year was the 31st of December. Property tax payments should be made in the name of the property owner on or before the due date.

Delays or defaults are penalized at 2% per month. In some cases, the penalty amount is also added to the next bill.