process work | kinds of things | gift deed | documents | expense | Income taxation | transfer of property

A document is known as a “gift deed” is used to transfer the ownership of a specific piece of property to another person. Let’s find out more by reading!

A legal instrument is known as a “gift deed” is often used to transfer ownership of a piece of property from one person to another. It is critical to have a thorough understanding of the significant financial repercussions that would result from transferring land ownership to a loved one before doing so.

Let’s discover more by reading, shall we?

What Exactly Is A Gift Deed, And How Does The Process Work?

A gift deed is a legal document used to transfer property or monetary assets from one individual to another. The elder sister is the recipient of a gift from the donor, which may take the form of either movable or immovable property.

The current owner of the property retains full authority over who could inherit it in the future so long as they have signed a gift deed for the property.

Disputes about who should succeed. Gift deeds are a kind of writing that may be used to transfer property without the need to go to court. This is in contrast to wills, which need a lengthy legal procedure to be carried out correctly.

What kinds of things do you expect me to bring?

To be able to give away a transferable asset, whether it be movable or immovable property, you will need to obtain a gift deed. This is the case regardless of whether the item is moveable or immovable. If you register your gift deed, you will have protection if you are sued.

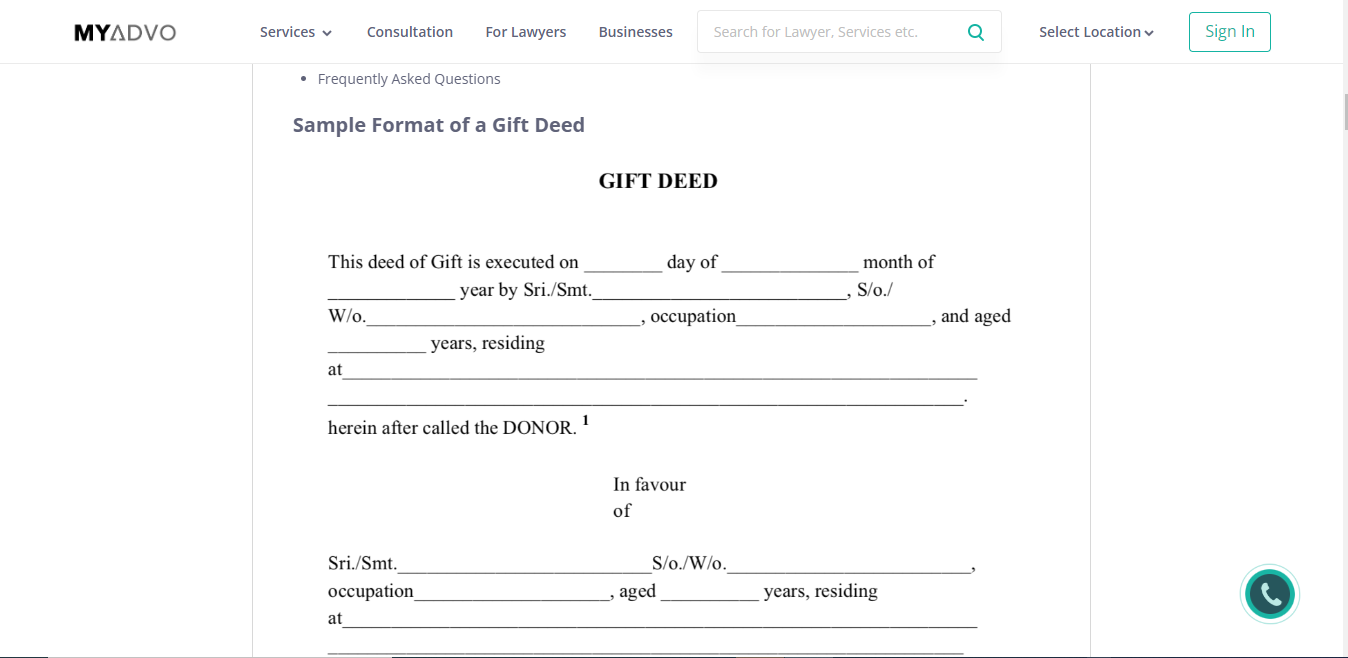

How Does One Go About Putting Together A Gift Deed?

A gift deed must include the following information:

- The location and the time that the deed will be signed and sealed.

- There is a copy of the signature, as well as the donor’s and the elder sister’s names, addresses, relationships, and birth dates.

- All of the information concerning the home is relevant.

- It is necessary to have two witnesses, both of whom need to sign the document.

After that, it should be printed on stamp paper and registered with the Registrar or Sub-Office, Registrar’s, after paying the necessary charge, which varies according to the amount established by the State Government.

Documents Belonging To The Registrant That Are Associated With The Gift Deed

If you have not done so, you will be required to submit the original gift deed, in addition to identifying documents such as an ID card, a PAN card, or an Aadhar card, in addition to the selling deed of the property. If you have not already done so, this step is mandatory.

The Expense Associated With Registering A Gift Deed

Registering a GIFT deed often requires a stamp duty payment, which varies from state to state. You can also make payment for the stamp duty in person or online. The following is a list of the stamp duties that are applicable in each state:

- Should I pay stamp duty on the gift of property I am making to a nonprofit organisation?

It is not necessary to pay stamp duty on a property donated to a charity or other organisation that works to benefit the community. Check with the regulatory authorities in your state first, however. It is against the law for non-governmental organisations (NGOs) to accept property donations in many different situations. Using the services of an attorney is the most effective way to track it down.

- Is it possible for me to take back a gift deed that I’ve already given?

Once a gift is given, it is considered part of the elder sister’s property and cannot be revoked. Following Section 126 of the Transfer of Pro Perry Act of 1882, a gift may be revoked under certain circumstances.

- There are further reasons for nullifying a gift deed, including fraud and coercion.

- The case will be thrown out if it is discovered that the reasons are immoral, lack legitimacy, or repugnant.

- Whether the gift deed may be revoked under certain circumstances, as was previously discussed and agreed upon.

- Even if the donor passes away, the donor’s legal heirs can go on with the revocation in such situations.

Gift Deeds Are Subject To Income Taxation

It is the receiver’s responsibility to provide gift information on their tax return (ITR). The Gift Tax Act of 1958 was terminated in 1998, but it was brought back in 2004 under a different moniker and with certain modifications.

You must be aware that if you are given an immovable property as a gift, you will be subject to a tax on the amount of the stamp duty if it is more than Rs 50,000. For instance, if the consideration of Rs 1.5 lakh is paid, and the stamp duty of Rs 4 lakh is paid, then the dispute is more than Rs 50,000.

There Is No Tax Imposed On The Transfer Of Property As A Gift

This rule does not apply if the property is gained through any of the following, and the tax paid is not used to pay the tax:

- A gift might be given to a person, a member of a HUF, or both.

- If it were presented to the receiver on the occasion of their wedding, for example.

- If it is an inheritance legally due to you or a gift from a relative who has passed away.

- If the payment is made with the knowledge that the payer or the payer will pass away shortly.

- A “local authority” is “any local authority” that receives money from the federal government, according to the definition provided under Section 10(20) of the Income-tax Act.

- Trusts and institutions referred to in Section 10’s funds, foundations, universities, other educational institutions, hospitals, and other medical institutions are included in this category (23C).

- If it originates from a trust or institution that is authorised by Section 12AA and is formally recognised by the Department of Financial Services.