Stamp Duty Meaning | Maharashtra Stamp Act | Salient Points | Save Tax | Factors For RR | Online Payment | Search For Challan | Stamp Duty Refund | Influencing Factors | How To Pay | FAQ

If you live in Maharashtra and you are looking to buy a new property and have it registered, you will need to know about the stamp duty and registration charges. There are a lot of different things you need to know and we are going to do exactly that here.

We will be sharing several particulars of the details about stamp duty and registration charges. There are a lot of rules and details that you need to know and we will be familiarizing you with the specifics. Knowing about these will aptly prepare you regarding what will be the right way to pay the stamp duty charges.

What Do You Mean By Stamp Duty?

Whenever a property transaction is being carried out, you will need to pay stamp duty and registration charges. These charges are valid under the Maharashtra Stamp Act.

Up till August 2022, in the last four months, the Maharashtra government ended up registering as many as 9.7 lakh documents and thereby they manage to earn a net value of Rs. 1776 crores. The IGR Maharashtra government had set a target for the current financial year at Rs. 32,000 crores.

Further, updates were launched that stated that the stamp duty charges in Mumbai, Pune, Nashik, Thane, Navi Mumbai, and even Nagpur will have a 1% metro cess. This is because these places have ongoing metro work ongoing.

As per a report, the government is expected a net review of Rs. 100 crores in Mumbai via metro cess in the year 2022 -23 alone.

From all the remaining cities in Maharashtra, the government is expecting net revenue of Rs. 900 crores. The government keeps introducing different updates and reforms from time to time and the focus is on helping the government stay at par with the different norms and rules in the right manner.

From offering waivers on properties resale to changing the stamp duty rates to even offering rebates when the property is registered in the name of women, several different amendments are introduced from time to time. The underlying idea is that you have to be aware of all the clauses as it is only then that you will be able to bring about the right change and know the best of property updates.

Buying a property is no small deal. It involves massive money and this is why you should make it a point to be aware of all the key details and charges that will be incurred. Doing this will prepare you in knowing the exact expenses that will be incurred. Even when this is a form of investment, you have to know the money you will be spending on it.

So, here we are going to familiarize you with the Maharashtra stamp duty details and thereby make you aware of the different specifics.

What Is Maharashtra Stamp Act?

The Maharashtra Stamp Act that is also known as the Bombay Stamp Act 1958 applies to all instruments that are mentioned in schedule 1. On these items, the stamp duty is payable to the state.

Apart from this, several amendments took place to incorporate different items. For instance, gift deed stamp duty drew a revision as well as penalty causes and other related aspects as well.

The Salient Points Of The Maharashtra Stamp Act

- The stamp duty papers should be the name of at least one of the parties. You cannot simply choose to have the name of the CA or the lawyer of the parties

- The date when the stamp paper is issued cannot be more than six months older than the date of the transaction

- All the instruments for which stamp duty has to be paid in Mumbai should be stamped either at or before the time of execution or maximum the day next to the date of execution

- In the case of the gift deed stamp duty, it is executed outside the territory. It can be stamped within three months after it is received on the Indian soil

- The adhesive stamps that are used on the deed including the gift deed stamp duty are always cancelled when the deed is executed. This renders them useless for any kind of reuse.

- You can pay the stamp day and registration charges by adhesive or impressed stamps on the deed.

How To Save Tax With Regards To Stamp Duty Maharashtra?

Whenever you are buying property, no matter how small or big, you are likely to look for ways by which you can save your hard-earned money it. Here, we are going to tell you how you can carry out tax savings with the help of stamp duty Maharashtra.

As per section 80C of the Income Tax Act, you can choose to avail income tax deductions for payments that you made against stamp duty and even registration or cess charges. But, the net IT deduction that is permitted is no more than Rs. 1.5 lakhs.

Further, as per section 3 of the Indian Stamp Act, it is compulsory to pay the stamp duty charges. No matter whether you agree to the sale of property or a license agreement or even a leave document, you will need to make the stamp duty charges.

When you are looking to opt for property sale documents, the stamp duty that you will have to pay will be the higher amount among the consideration value of the property or the ready reckoner rate or even the circle rates as had been decided by the government. So, you have to find out each of the charges and then decide which one among them is the highest and that will end up becoming your stamp duty charges.

For all properties that are priced below 30 lakhs, the property registration charge in Maharashtra is currently 1%. For properties whose value is above 30 lakhs, the registration amount has been capped at an upper limit of Rs. 30,000

Here, we will give you a summary of the ready reckoner rates and it is therefore upon you to decide which city seems to be the apt choice.

| City | RR Rate (in Percentages) |

|---|---|

| Aurangabad | 12.38 |

| Ahmadnagar | 7.72 |

| Latur | 11.93 |

| Malegaon | 13.12 |

| Mumbai | 2.6 |

| Nashik | 12.15 |

| Navi Mumbai | 8.9 |

| Panvel | 9.24 |

| Pimpri Chinchwad | 12.36 |

| Pune | 6.12 |

| Sholapur | 8.08 |

| Thane | 9.48 |

| Vasai | 9 |

| Virar | 9 |

As you can see, different cities and places have various slabs for such rates and it depends on a plethora of different factors. So, you should feel free to check these details and then come to the right decision especially when you have the liberty of buying property in different places.

When the stamp duty is collected, the ready reckoner rates and also the property value as it is stated in the buyer-seller agreement is taken into account. This is why even the stamp duty has variable charges because as you can see the reckoner rate tends to differ a great deal.

The pandemic had hit even the government hard as the real estate market took a major slump. This is why the government wants to do all it can for the sake of being sure that it can generate the right revenue it. This is why they increased the ready reckoner rates in the state on March 31st, 2022. From April 1st, 2022, there ended up an increase of 5% across Maharashtra. This doesn’t include the details of Mumbai. Along with this, when it comes to the municipal corporation, the ready reckoner rate saw a hike of as much as 8.8%

So, now that you see that there is so much discussion around the ready reckoner rate and they tend to vary a great deal. Let us see what it depends upon.

Factors On Which The RR Depends

Several important factors decide the ready reckoner rate. Let us see what they are.

The location

The place where the property is located will have a lot of roles to play in deciding the ready reckoner rate. There are as many as 19 different zones in Mumbai and 221 sub-zones. So, one can see how varied the location circles are and therefore just how much the variation in ready reckoner rate is possible.

The Market Value

The market value of the property is a very important factor. If the property comes with several facilities and amenities, it will also impact the rate and push it higher. Mostly, the better the prosperity, the higher the rate.

The Property Type

You need to understand well the type of property you are dealing with. Commercial and residential properties have varied rates. Commercial properties tend to have comparatively higher ready reckoner rates.

Even when it comes to residential houses, the type of house is going to decide the rate. For instance, if the same locality has a villa, a small apartment, and a bungalow; the RR rates are going to differ for all three house types. So, the style of the house will again have a lot of roles to play in deciding what is the best choice.

During the pandemic, the state didn’t bring in any changes to the rates. People were already going through a rough patch and the economy was badly hit. Some so many people had lost their jobs and means to earn. So, there was no surge in rates. However, in September 2020, when things started slowly creeping a little back towards normalcy, the government brought in a very minuscule and minor increase in the rates.

It is worth adding that the government had cut down the stamp duty in Maharashtra, mainly in Mumbai and Pune, during the pandemic times.

This was such a welcome move and it helped people think again about buying properties. The moment the stamp duty rates were cut and the economy got slightly better, there was a surge in the real estate sector, especially in Mumbai and Pune where the slashed rates were announced.

As the cost of property is so high, even small changes like a reduction in stamp duty end up helping people make a significant amount of savings. So, it is important to do the needful.

The Online Payment Method

The Maharashtra stamp act was amended. It was mainly done to offer scope for online payment. Here are the steps that you need to follow for paying the stamp duty charges.

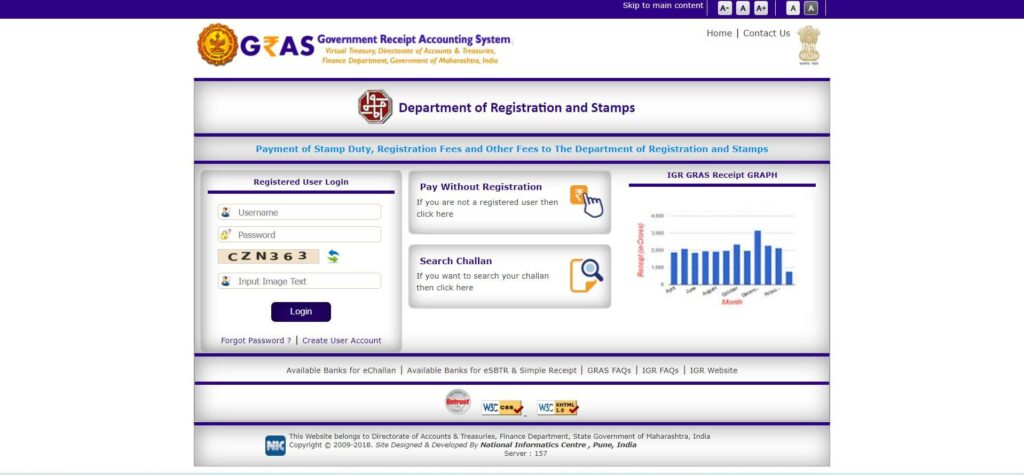

- Head to the Maharashtra stamp duty online payment portal

- Now click on the option that reads ‘Pay without registration’. You will choose this option only if you are not registered with the Maharashtra stamp duty portal.

- If you have chosen to register on the site, you can then fill in the login details on the portal

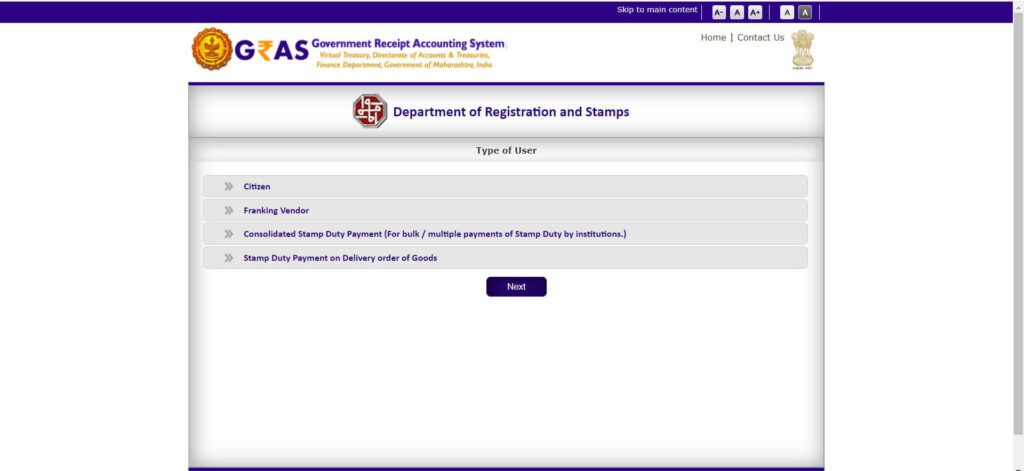

- If you have selected the pay without registration option, you will then be redirected to a new page. There you have to choose Citizen and then you will need to select the type of transaction that you want to execute

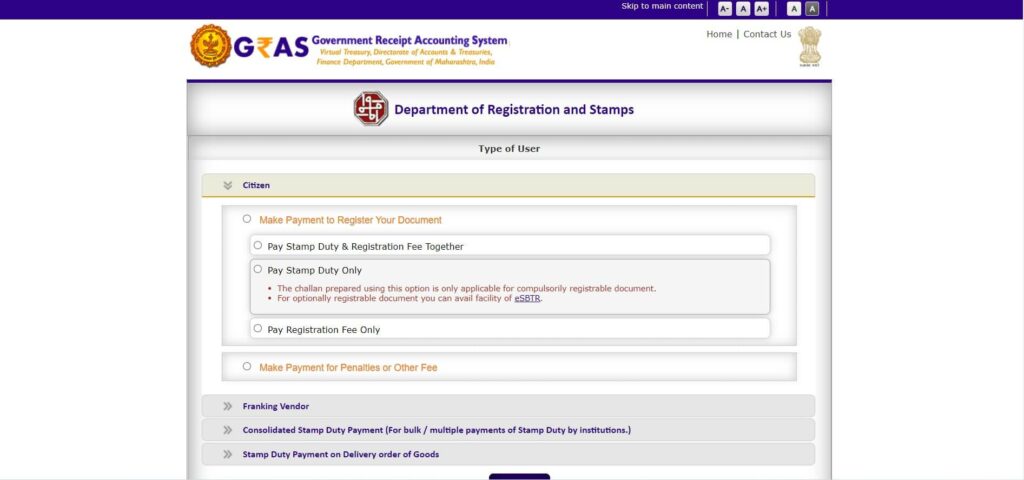

- Now choose the option that reads ‘Make payment to register your document’

- Now you can choose to pay the stamp duty along with the registration charges or even both of the charges as well

- Make sure to fill in all the particulars that are listed. You will need to enter the details of the district, payment, party details, property value and more.

- Choose the appropriate payment option and then proceed with it.

- A challan will be generated, make sure to keep it as it will have to be presented when the deed is executed

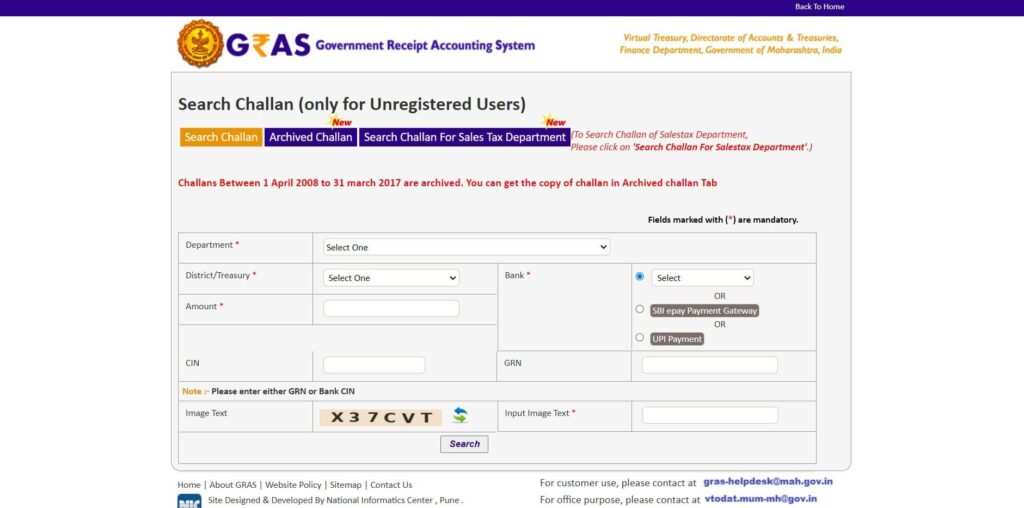

How To Search For Challan?

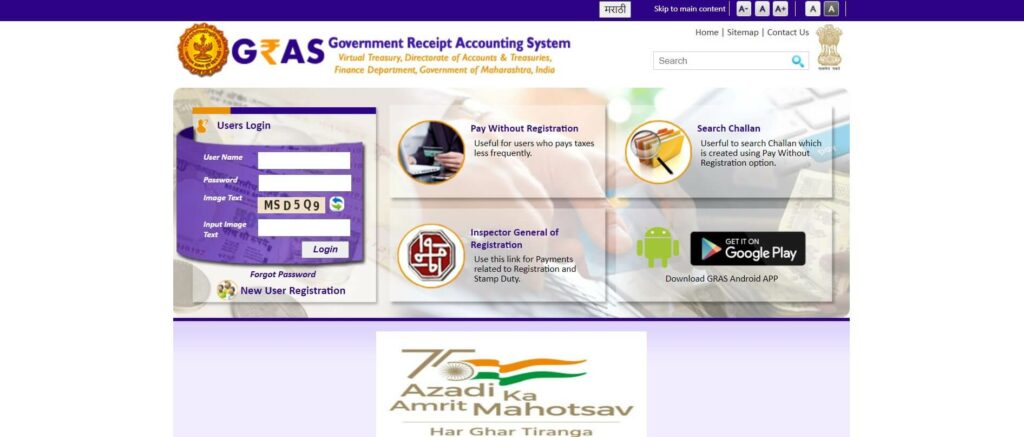

You can use the Mahakosh portal for paying the stamp duty and registration charges but it also has other uses to serve. You can use it for searching your challan as well.

- Login to the portal by clicking on the official site

- On the home page, you will find an option called Search challan. Click on it

- A new page will pop up that will ask you for several details. You will have to duly enter the details including the district, amount, bank, payment gateway and more

- Then click on search

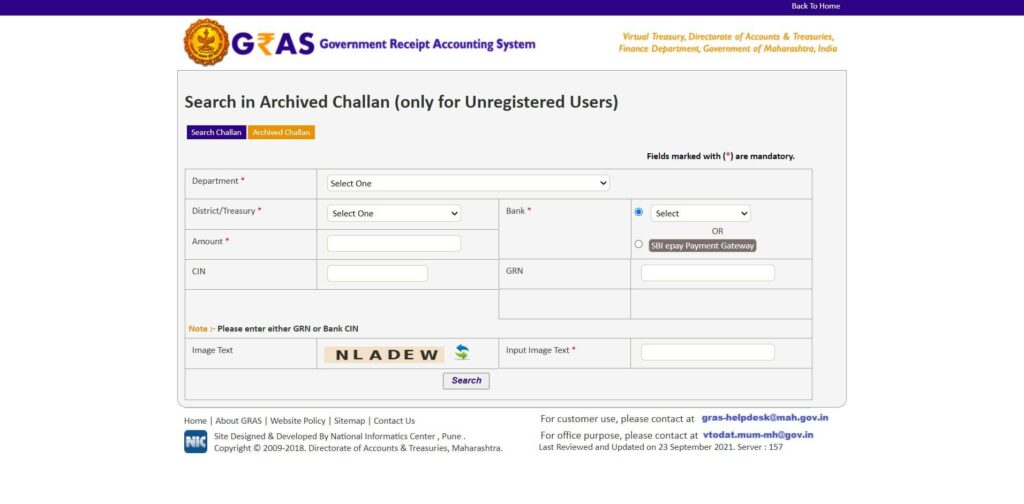

- You will then get the details of the challan. You can also check the archives option to find the details of the challan

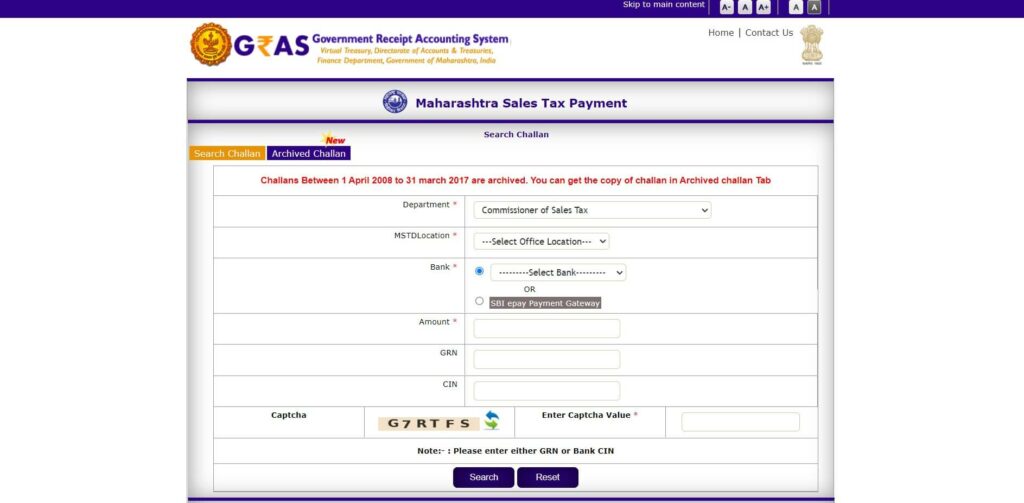

- If you are on the lookout for challan for the sales tax department, you can choose to search challan for the sale tax department and it will give you the required details in the right manner.

The Banks You Can Choose For E-Challan

When you are looking to make payments, it is important to know the list of banks that have payment options. You can choose any of the supported payment options and this will allow you to pay off the stamp duty charges in a diligent manner.

Head to the mahakosh portal and when you are looking to make a payment, click on the option that reads ‘All major banks, debit card, credit card are accepted.’

The list of major banks includes the following

- Allahabad bank

- Andhra bank

- Bank of Baroda

- Bank of Indian

- Bank of Maharashtra

- Canara bank

- The central bank of India

- Corporation bank

- City union bank

- Dena bank

- DCB Bank

- Indian bank

- Indian overseas bank

- IDBI bank

- Oriental bank of commerce

- Punjab national bank

- Union bank

- Vijaya bank

- UCO Bank

- State bank of India

- Syndicate bank

Cases Eligible For Stamp Duty Refund

There are a few cases wherein you are eligible to get a refund for the stamp duty. Let us see the possible scenarios.

- The presence of writing mistakes has rendered the stamp duty paper unfit for use

- The transaction has been deemed illegal under section 31 of the specific relief act

- Any of the binding parties decline to sign the stamp paper

- The paper is unsigned and both the parties agree not to use it

- The court says that as per section 31 of the specific relief act, the transaction is deemed to be entirely illegal

- Any of the binding parties state that they do not comply with the terms and conditions

- The person whose signature is essential refuses to sign it or has died before signing it

- If the stamp paper value is not sufficient and the transaction was completed with another stamp paper that had the correct value.

- The stamp duty paper got spoiled and a new paper document was used for the same purpose

Filling Online Info

Whenever you are looking to opt for a stamp duty refund, it is important to enter several information through the online system. When the information is filled out online, you will get a token and then you need to apply in an offline manner. Let us take a look at the details of the process.

- Head to the IGR Maharashtra website and then choose the option that says Online Services

- Now click on the option that reads stamp duty Maharashtra refund application link

- Now check on the box that says that you agree to the terms and conditions

- Click on the option that says New Entry

- Enter details like mobile number, OTP, and captcha as well

- This will generate the stamp duty Maharashtra refund token number

- Now you need to create a password and then click on submit

- If you had already registered the document and you are looking to get a refund, you will have to enter more details like the document number, the date, and even the SRO details.

You will also need to enter the details of the stamp. Here are some of the particulars you will need to fill in:

- The type of the stamp whether it is franking, e-SBTR, or e-Payment

- Enter details like the name of the stamp vendor and his address

- Also include details for the name and related details of stamp purchaser and stamp value

- When you have added all the details, an image code will appear in red. You need to mention the code and then choose the Register button

- Once you have done this, the stamp duty refund information is then submitted and you can then head to the acknowledgement tab.

- Now enter the stamp duty refund token number in the application and this needs to be submitted to the office of the collector of stamps

- This will kickstart the stamp duty refund Maharashtra process

Influencing Factors

Stamp duty in Maharashtra depends on a lot of different factors. Here are the details of the factors that influence stamp duty. They are as follows.

Age of the person

If the person who chooses to buy the property is a senior, they are likely to get reduced stamp duty in Maharashtra. So, senior people are likely to get concessions in stamp duty charges.

Age of the property

Just like the age of the person, the age of the property assumes a vital role too. If the property is old, it is likely to have less stamp duty compared to when it is new. New properties are likely to attract very high stamp duty charges.

The gender

Sometimes, women are given several concessions when it comes to stamp duty charges and therefore they may get a rebate. The stamp duty rates for females are very attractive and are often revised by the Maharashtra government from time to time.

The type of property

The stamp duty will depend largely on the type of property you have. The residential property will command lesser stamp duty in comparison to commercial properties. Based on the type of property you have, the overall stamp duty charges are going to vary a great deal.

The Right Ways To Make Payment

You can make stamp duty payments in any of the three ways.

Franking

Here the agreement is printed on paper and it is then to be submitted to an authorised bank. When you have submitted the documents for the payment, it is then processed with a franking machine. It is a very common payment method.

Stamp Paper

In this form of payment, the stamp duty can be paid using stamp paper. All the agreement details are listed down on a paper and it is then signed by the authorised person after he has duly checked the details.

Once this is done, the stamp paper is then registered at the sub-registrar office. The stamping is done after 4 months.

You can also check out property tax Mumbai details for more in depth idea.

E-stamp

This is one of the most common and popular methods of paying stamp duty in Mumbai. Here, you can make the payment using TYFS or even NEFT. Make sure that all your documents have been submitted duly.

FAQ

What is the stamp duty rate in Mumbai?

Currently, the stamp duty rate is 6% and this includes a 1% metro cess. However, this rate varies a great deal based on the city and locality and it is always advised to have it checked duly.

Different states have different methods. For example, if you want to know stamp duty rates in Andhra Pradesh, you will haver to refer to the state.

How do you calculate the stamp duty and registration charges in Maharashtra?

The market value and the ready reckoner rates are taken into consideration for the sake of calculating the stamp duty and registration charges.

Can you opt for a stamp duty refund?

There are certain cases wherein you can choose to opt for a refund of the stamp duty. You have to make sure that you are checking all these factors duly and then deciding the right course of action to take. There is a specific process to opt for and we have shared the details. Make sure to follow the details systematically and then get a refund in the right way.