Stamp Duty Meaning | Charges In Bangalore | Surcharge | How To Calculate | Influencing Factors | FAQ

When you are looking to buy a property in Bangalore, you will need to know about the stamp duty and registration charges in Bangalore, Karnataka. Recently, the government slashed the rates from 5% to 3% for the properties that fall in the affordable segment which is for the price up to Rs. 45 lakhs.

So, here we are going to shed light on the amount of money you will be paying as stamp duty and registration charges when you buy properties in cities like Bangalore. It is very important to add that every state has their separate charges that they levy and therefore the stamp duty rate is going to vary from one state to the other.

So, we are going to offer plenty of details in this regard and prepare you in a better way as to what is the apt decision.

What Is Stamp Duty?

Stamp duty is the legal fee which the buyer needs to pay to the sub-registrar of the area at the location of the property itself. This is done to ensure that the property gets registered in the name of the buyer in the government records itself. It is one of the mandatory charges that you need to pay and there are no second guesses about that.

The Stamp Duty And Registration Charges In Bangalore

You need to understand that buying any property in Bangalore will make you adhere to the stamp charges of Karnataka as it is the state government that decides the final rate that will be levied.

The Karnataka assembly had passed an amendment to The Stamp Act, 1957 and announced that the state had decided to cut down the stamp duty on properties that were priced between Rs. 35 to 45 lakhs. Earlier the rate was fixed at 5% and this was later brought down to 3%. This reduced rate for stamp duty was only applicable on the purchase of any new property and not on transactions that had happened earlier.

Apart from the stamp duty stages, one also needs to pay the registration charges. Both the charges are compulsory and you need to be sure that you are paying them. The registration charge is usually 1% of the deal value and it is over the stamp charges that you are already paying. So, make it a point to analyze these costs when computing the total charges.

In Karnataka, there is no difference between the stamp duty charges for female property owners and for male property owners. Some states make it a point to offer rebates to female property owners and thereby promote their ownership too.

The Surcharge On Stamp Duty

Apart from paying the stamp duty charges, you also need to pay cess and surcharge as well. These too are a part of the total property purchase cost. If you buy a property that is priced above Rs. 35 lakhs, you will need to pay a cess of 10 percent along with a surcharge of 2%. This slab applies to urban areas.

If you buy a property in a rural area, you will pay a surcharge of 3%.

How To Calculate The Stamp Duty Charges?

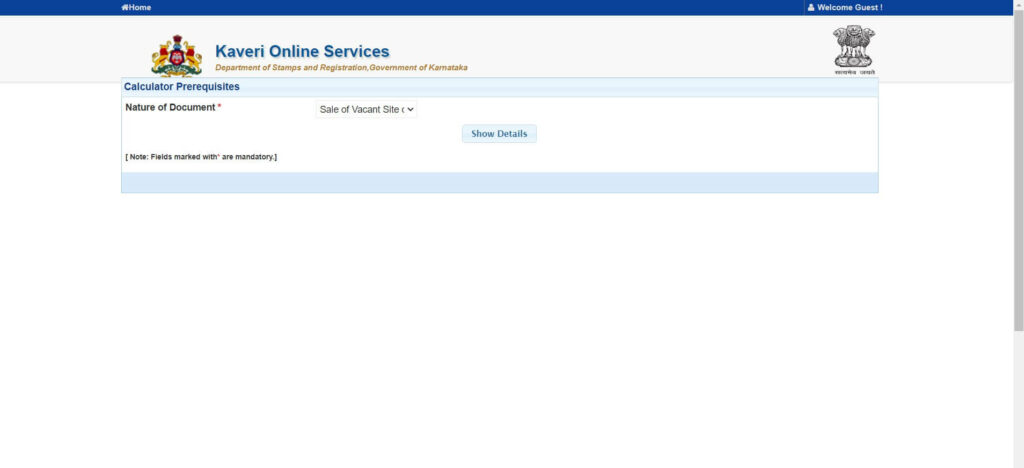

If you want to know the methods by which you can determine the stamp duty charges, here are the steps you need to follow. We will use the Kaveri Portal for making the payment.

- Head to the Kaveri portal and then look for the stamp duty calculator option.

- Make sure to fill in the particulars as requested. You will have to enter details about the nature of the document. This is because different documents will attract varied stamp duty rates. So, the nature of the document is an important point you need to share details about.

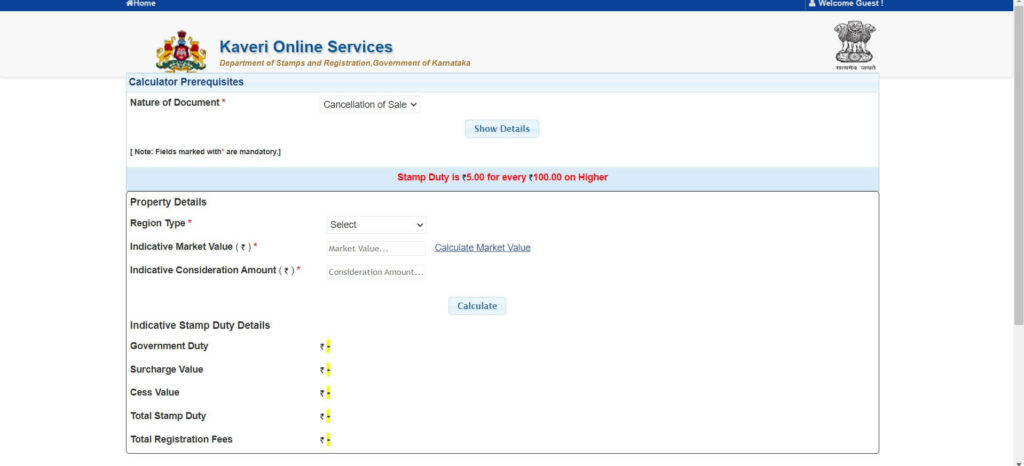

- Now you will be asked to fill in more particulars including the type of region. You need to answer whether is it a corporation, panchayat, or anything else. You have to be sure that you are entering all the requested details with due diligence.

- You will also be asked to fill in the indicative market value and the indicative consideration amount as well. You can use the calculator for the sake of calculating the market value if you don’t have the key numbers and details.

- Once you have filled in all the required information, you then need to use the stamp duty charges calculator and it will show you the indicative stamp duty charges along with the cess, surcharge, and even the registration fee. This will therefore give you the net total fee that will be incurred during your decision to buy the property.

Factors That Influence The Stamp Duty Charges

Here are some of the factors that will influence the total stamp duty charges in an area.

The age of the property

It is usually seen that the older properties tend to be cheaper as compared to the modern new properties

The gender of the owner

In a lot of states, women are given rebates and therefore they need to pay lower stamp duty. However, when it comes to Karnataka, the rates are the same regardless of the gender

Location of Property

It is usually seen that properties that are located in modern and urban areas tend to attract higher stamp duty charges

The age of the buyer

Senior citizens are usually made to pay lower stamp duty charges compared to the rest of the people

The nature of the property

When you compare residential and commercial properties, it is usually seen that commercial properties will have a higher rate

Amenities and services

The more amenities and services, the higher will be the stamp duty charges.

Apart from this, there are several other small and big factors that tend to influence stamp duty charges. These factors will also end up having an impact on the registration charges that are incurred as well. So, you need to weigh everything and assess the final price you will be paying before you decide to purchase a property.

FAQ

Which cities have high stamp duty charges?

Chennai, Kerala, and Hyderabad are known to have very high stamp duty charges

Does the seller pay the stamp duty or the buyer?

Usually, it is the buyer who pays the duty unless otherwise mutually decided and listed in a legal contract

Does the state charge the stamp duty rates?

Yes, the stamp duty rates are levied by the state government and the percentage, therefore, varies from one state to the other.