Relinquishment Deed Registration | Important Considerations | Process | Documents | Special Category | Benefits | Relinquishment vs. Gift Deed | Cancelation Terms

The legal way the co-owner of a joint Hindu property gives up their right to the property is by relinquishing their ownership through what’s called “Relinquishment Deed”. Relinquishment Deed is created and registered between legal heirs whereby co-heirs transfer their share in the property to another heir. In this article, we will discuss the “Relinquishment Deed Registration”.

All About Relinquishment Deed Registration

You might be wondering to know more about the Relinquishment Deed. Let’s get started! Some people don’t care about drafting their will when alive, and they might eventually die having none. This situation where someone dies without creating a will is known as intestate. In such a situation, if there are two or more legal heirs, they can opt for a Relinquishment Deed which enables them to smoothly transfer the property or to bid to separate the possession.

Therefore, Relinquishment Deed is a legal statement in which a legal inheritor gives up his/her inherited property in favor of another heir. When a person dies intestate, and the location of the property he left behind is not in favor of some heirs, they can decide to make a Relinquishment Deed by transferring what belongs to them in good faith to another heir who is close to the location of the property.

Relinquishment Deed will be authorized either for consideration or with no consideration. Contrarily, the parties pertained to must be legal heirs to the possession for the transfer to be renounced.

Important Considerations Included in the Relinquishment Deed

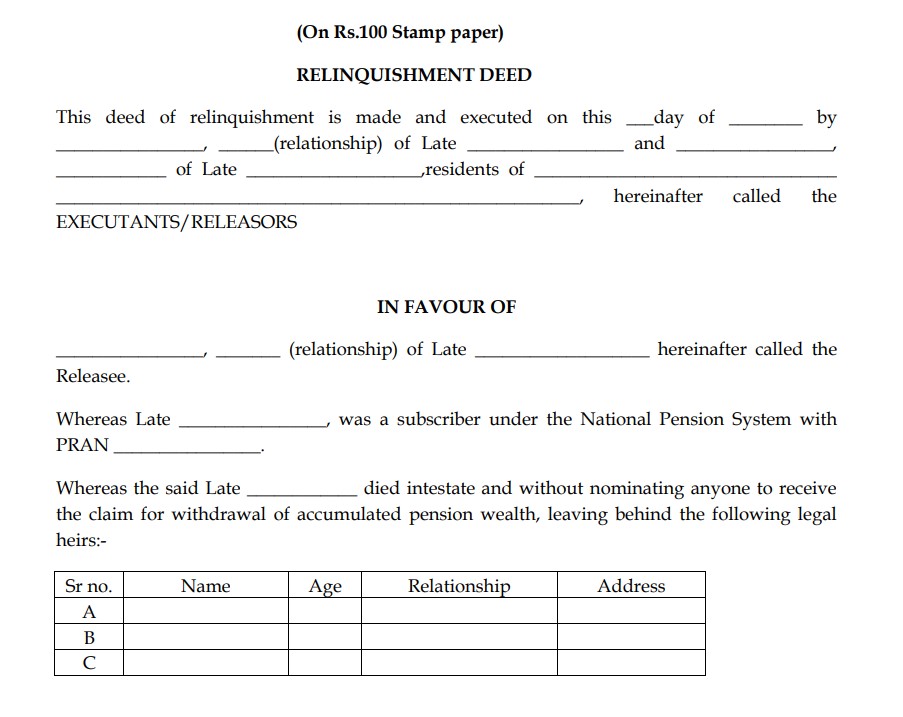

Important headings and agreements that must be included in the Relinquishment Deed document include;

Title description: The first headings should be the name of the document, “Relinquishment Deed/Deed,” and the details of the date when the document is created.

Executant and releasor: Since someone wanted to relinquish his right in favor of the co-owner, the individual who makes this Relinquishment is recognized as the executant/ releasor. Handful details of the person will be taken down, including full name, father’s name, and house address.

Releasee: The person to whom the property is relinquished is known as the release. The release details are important and must also be included in the document; full name, father’s/husband’s name, and full house address.

Details of the property: It’s believed that property owned by a single individual cannot be relinquished. Heirs can only release property to themselves if there is no absolute owner. Hence, the full name of the last owner must be written on the property, and all minute details, including; complete address, survey number, registration details, sub-registrar office details like book number, volume number, name of the office, and others.

Heir details: Detailed information of all present heirs should be taken down, including; their name and title, age, address, and relationship with the absolute owner of the property (the deceased).

Other Considerations

Purpose of Relinquishment Deed: You can’t just relinquish property to another person without a tangible reason. The purpose of Relinquishment must be stated in the document. If the property owner has made a will, there wouldn’t be any complications that will result in creating a Relinquishment Deed. Distance barriers may also be a reason for Relinquishment. Whatever the reason might be, it should be included in the document.

Share particulars: According to secession law, if a person dies without making a will, his heirs will automatically inherit his assets. If there’s no occurring will to the creation of the Relinquishment Deed, the percentage/proportion of shares held by each inheritor should be included.

Relinquishment: The executant/releasor relinquishing their share in the possession in good faith to the release is the most significant clause in a Relinquishment Deed. Before releasing one’s share in a property to another heir, it must be out of love and affection or to avoid misunderstanding.

Once a person has relinquished his/her share to another heir, he/she will no longer have any legal claim on the property. Hence, before the property right can be vested on the release, the remaining heir must agree and release their portion of the share in good faith.

Authorized signature: Before the sub-registrar office officially approves the Relinquishment Deed, it must be signed by both the release and releasor and two witnesses from the property location.

Who can create a Relinquishment Deed?

Only a legal heir of a particular property can relinquish their portion, and it must be in favor of another legal heir.

Process of Registering a Relinquishment Deed

Relinquishment Deed must be created per section 17 of the registration act, 1908. This is because relinquishing property to another heir is a complicated process that must be done according to law to avoid any form of conflict in the future. The following are the steps to follow in the enrollment of Relinquishment Deed;

- Step 1: Firstly, you will be required to structure all the necessary information that needs to be in the Relinquishment Deed on Rs 100 stamp paper. You need to be extra careful while filling in these details, ensuring you avoid any grammatical or typographical errors in the created draft. Your writing must be clear, and every party involved should be able to comprehend the draft language.

- Step 2: The next phase is visiting the near sub-registrar office near your residence, along with all those who are concerned in the process. Also, two witnesses you are taking along, and everyone must carry the original and photocopies of their identity proof, passport size photography, and their residential proof.

- Step 3: You must pay a nominal fee of Rs 100 and Rs 250 for registering a Relinquishment Deed.

- Step 4: If the sub-registrar office official has gone through all that you filled out and they are satisfied, the document would be officially registered. And a registered Relinquishment will be out in a week. Visit any nearby sub-registrar office to collect your papers for future purposes. It must be noted that the unauthorized Relinquishment Deed is invalid and can’t be used for contesting in the Court.

Documents Required For Relinquishment Deed Registration Format

- A written document stating the purpose of Relinquishment.

- Legal document of the property.

- Name of executant, age, and address.

- Particulars are required for a release deed.

- Registered document.

- Co-owners details

- Name of the release, age, and address.

- Aadhar card, ID proofs like passport, driver’s license, etc.

- Property description.

- Details of consideration.

- Pan card of both releasee and releasor for the registration of Relinquishment Deed.

- Two witnesses at the property location.

- Any agreement you’ve reached concerning the property.

Crucial Points to be Considered

- Property should only be relinquished to a legal heir of the deceased, and the other co-owner must agree to the Relinquishment Deed.

- If the property is relinquished to a person that’s not a legal heir, the process will be carried out like a gift.

- The relinquishment Deed must be signed by at least two witnesses and all parties involved.

Special Category

People with disabilities might be unable to visit the sub-registrar office. However, there’s a solution if such an issue should occur. As per “section 31 of the act,” in case a person is physically disabled and cannot visit the sub-registrar office, the registering officers are sanctioned to take the Relinquishment Deed form to his/her residence for registration.

Benefits of Executing a Relinquishment Deed

- Secure transfer if there’s no will: If the absolute owner of the property dies without making a will (intestate) Relinquishment Deed can be used to transfer property without causing any future conflicts.

- Other heirs: The relinquishment Deed allows a legal heir to transfer his/her part of the share to another legal heir.

In one word, Relinquishment Deeds allow smooth transfer of property Between joint owners.

Difference Between Relinquishment Deed and Gift Deed

A gift Deed is another way of releasing property to a person without a legal heir. Gift Deed and Relinquishment Deed are similar but different on several grounds.

- Beneficiary: The document will be processed in the property owner’s name. As far as the gift Deed is concerned, the property can be relinquished to anyone regardless of whether the person is a legal heir to that particular property.

- Stamp duty and registration: Relinquishment Deed and gift Deed must be registered before they can be considered valid. Both documents must be registered before they can be assumed legal. However, the stamp and nomination fee of the gift Deed is usually higher than that of the Relinquishment Deed.

- Consideration: As per the rules that bound the process, no money should be taken from the release. The property must be released in good faith. Contrarily, Relinquishment Deeds can be done with or without the same consideration.

Cancelation Terms

Both deeds are irrevocable once the agreement has been signed. The registering officers will ask for any necessary information before approving the document. However, the owner who has transferred a portion of the property can revoke the Relinquishment Deed on certain grounds;

- Maybe he/she has been scammed.

- Maybe he/she has been pressurizing or threatening to Relinquish his/her portion.

- If the releasor intention has been misinterpreted in the former document.

And for this to be successful, all parties involved must agree to the cancellation. If the beneficiary refuses, the aggrieved should approach the civil court.

Note: the Relinquishment Deed must be revoked within three years after the right has been conferred.

In a nutshell, a Relinquishment Deed is a document that allows a legal heir to transfer his/her share of the property to another co-heir by following the legal and approved process. This article will offer you the basic knowledge you should have on Relinquishment and gift Deed, the definition, registration, consideration, cancellation term, and others.