Banking Services | Retail Registration | PNB User ID | Corporate Registration | Password Reset | PNB Login | Online Transaction | Fund Transfer | Bonus

Punjab National Bank is one of India’s oldest and most reputed public banks, with over 395 billion rupees in market capitalization. PNB bank offers a wide range of services throughout different states in banking, loan, and more.

One can opt for saving, current and other accounts for a minimum balance to start availing of all the fantastic services from this option.

The best part is PNB online net banking, which allows users to send/receive money, check passbooks online, transfer money internationally, and much more. All this is possible through the PNB online net banking app called “PNB One” and www.pnbindia.in for a better experience.

Also, read about Axis Bank Internet Banking!

Here, we will dive deep into all the services offered by PNB online net banking, how to use them, and additional services. Let’s get started.

PNB Online Net Banking Services

All the services from PNB are further divided into two different categories:

PNB Retail Internet Banking

PNB Corporate Internet Banking

You can access it through the official website and the PNB one app, which is available for Android and iOS devices.

Instead of learning about all the essential services, let’s jump onto the critical services and what’s newly added.

Change PNB Home Branch

Changing the home branch is a standard service faced by most students, office employees, army men, and other professional employees. However, changing a home branch from one location to another was the hardest as you had to visit the home branch and fill out forms.

But, you can do it quickly with the help of the Change PNB home branch feature added to the official website.

Change Account Variant

Accounts have different variants or types. For example, you have heard of PNB Gold, PNB Platinum, and similar debit and credit cards. There is a premium for each debit card type; some people don’t want the feature for long, while others want to upgrade to new features.

For such issues, PNB offers a change account variant feature for CSMR accounts. Therefore, you can easily consider the requirement and do this work online.

Positive Pay Service

Two-factor authentication adds a significant layer of safety to users’ accounts and is undoubtedly a great feature. However, it was a missing feature with cheques. You can now do positive pay by filling out the date, amount, and other cheque details.

This IBS secondary authentication helps in several manners to protect PNB users from getting into fraud.

Pay Domestic Bills

From paying setup boxes to electricity bills, the functionality to pay bills online through PNB net banking was missing for a long time. Now, PNB is catching up, and they have introduced this BBPS service for all users.

Additional Features

Here is the list of all other unique features offered by PNB net banking for an excellent experience for its users:

- Account wise TDS Details.

- Online Registration & Password Reset facility

- View Account details

- Statement of a/c

- Nomination details

- Transaction History

- Fund Transfer within PNB

- Self Transfers

- FD/RD

- Modify FD/RD instruction

- PPF Account opening

- Tax Payments

- PPF Accounts

- SSA accounts

- OD for PMJDY Accounts

- Utility Bill Payment

- Credit Card Payment

- FD/RD

- Modify FD/RD instruction

- PPF Account opening

Alongside this, there are many more features that users can avail of from PNB. If you are a new user, you can check out our detailed section on registering for internet banking, using them, and additional factors.

How to Register for PNB Net Banking? – For Retail Users

PNB has made things relatively easier by reducing the steps in registering for PNB net banking. You can consider using PNB one app or the official website. Here is the online method to register for retail users through the web interface.

Step 1: Visit the Official Website

Begin by opening any web browser of your choice. Using Chrome is a better choice in most situations, but you can also consider Firefox or Safari. Make sure that you avoid using a public computer for safety purposes.

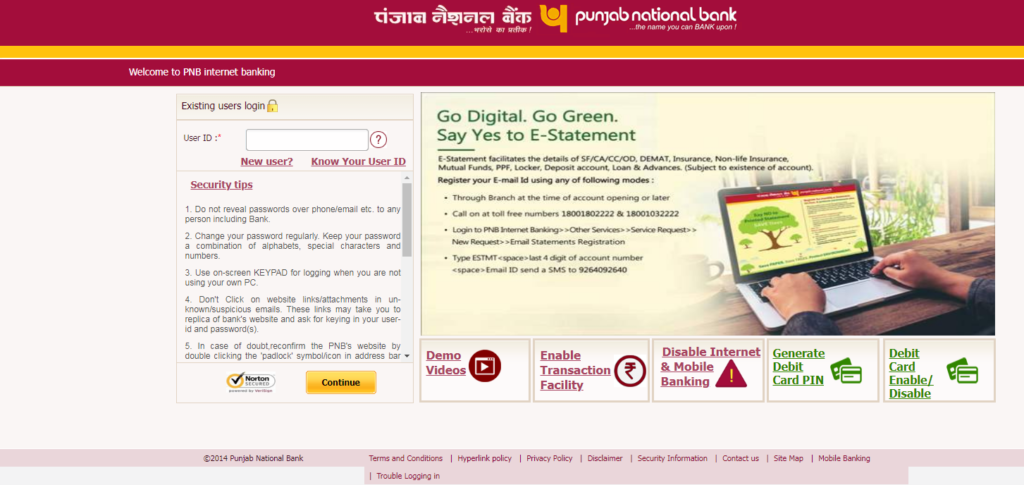

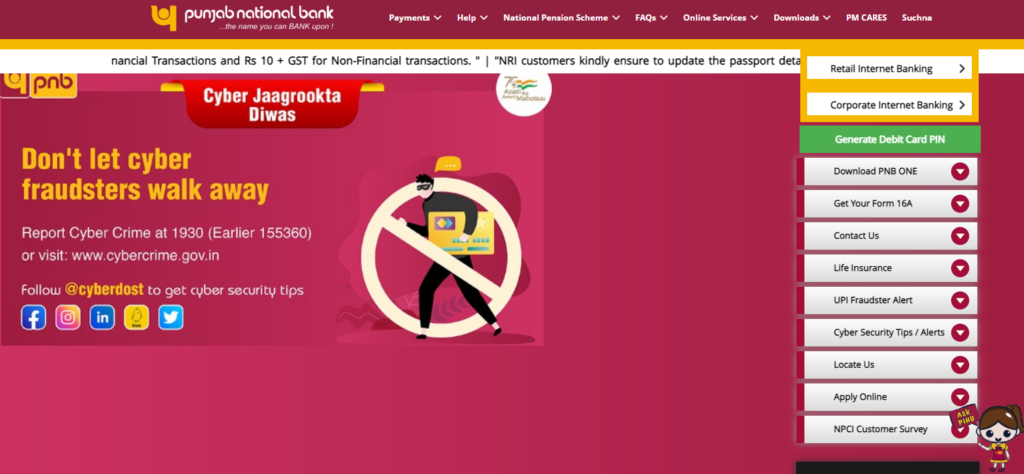

On this first page, you can find the option “Internet Banking” on the right corner. Click on this button, and you will get two options on a new page. First, choose the “Retail Banking” option.

Step 2: User ID

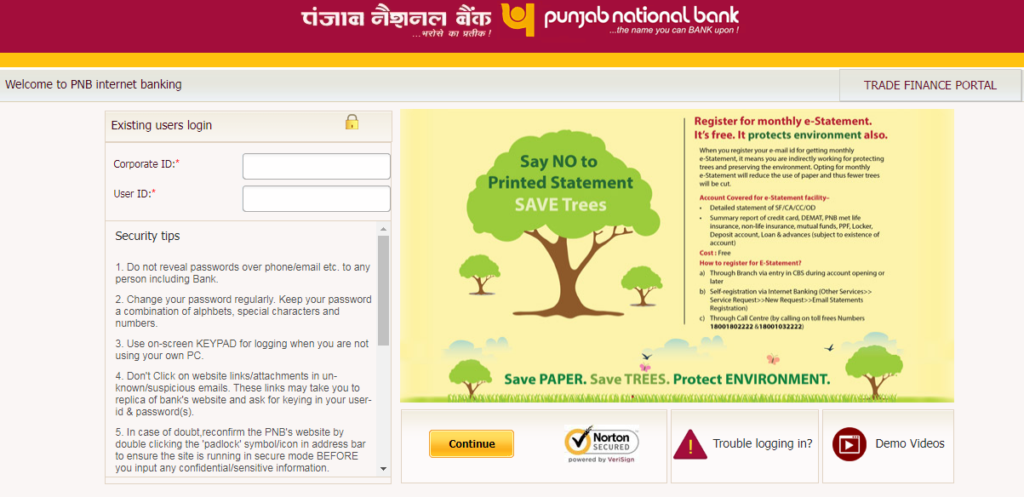

A login page will load after tapping the Retail Banking option. There are two ways to get your user ID. You can find the user ID in the passbook provided by the bank, or you can opt for a new user registration process.

If you don’t know the user ID, click on the “New User?” option, which will take you to the registration form.

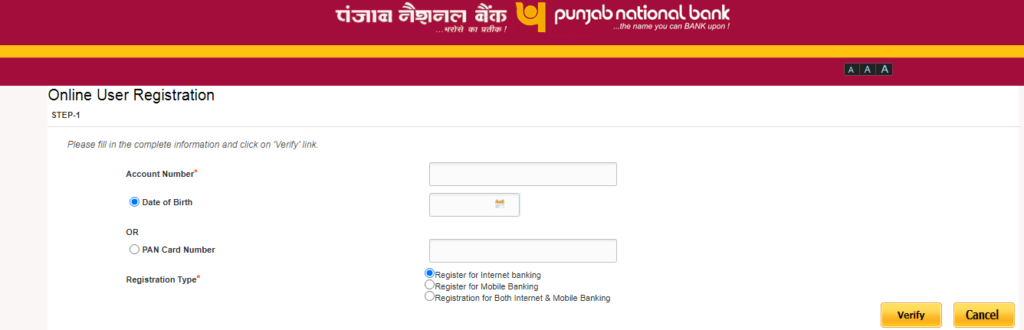

Step 3: Fill Out Details

Make sure you have the bank passbook nearby to fill out the details. Fill in your account number and date of birth. Check the information and then choose the “Registration for Both Internet & Mobile Banking” option. Then hit the “verify” button. You can consider filling in the Pan Card Number instead of DOB.

Once the details are filled in and you have clicked verify button, you will receive an OTP on the registered mobile number used in the bank account. Enter OTP and hit continue.

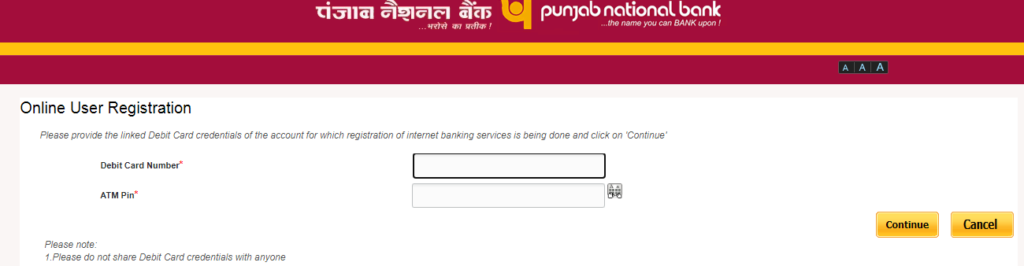

Step 4: Debit Card and ATM Pin

This time, you need your debit card number, and you have to enter the pin. Once you enter both and hit continue, you will get your account details on the following page.

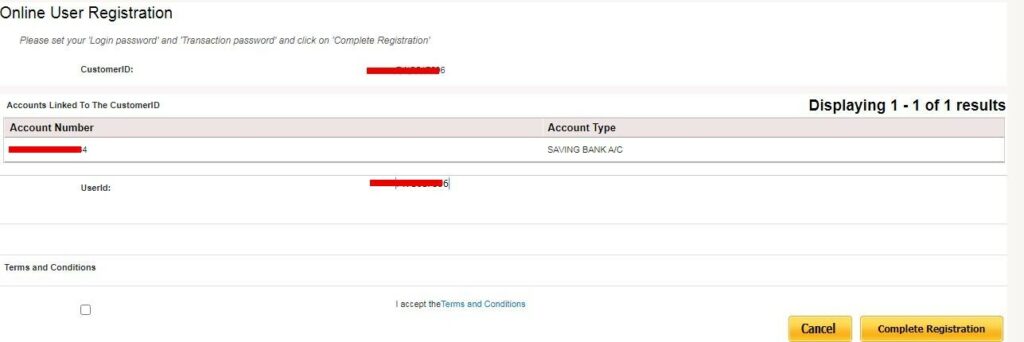

Select the bank account from the options based on saving or current account type. You can also find the user ID mentioned below. Next, tick the terms and condition box and finish the process by hitting the complete registration button.

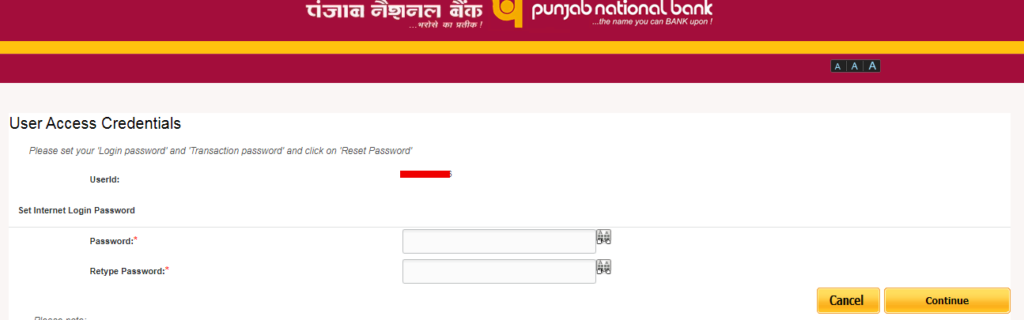

Step 5: Login and Transaction Password

Remember to set the Login and Transaction password before hitting the finish registration button.

Once you have completed the process, you can consider logging in with the user ID and password you set. Make sure to write the username somewhere safe so that you forget the user ID and can still log into the account.

Important Note: Due to some bug, some users don’t get the option to set the password for internet banking, which complicates things as there is no other option to set a password online. Such users can consider using PNB one app, or they can visit the nearby branch to fix the issue.

How to Know your PNB User ID? – Know Your User ID

Some users don’t opt for internet banking daily, and the chances of forgetting your user ID are higher. PNB offers the “Know Your User ID” option to eliminate this problem. This option can help you retrieve the user ID with the bank account number and DOB.

- Go to the retail internet banking option on the PNB website.

- You can find the option to log in with your user ID.

- There is an option called “Know your user ID” below the given option.

- Fill in your account number and DOB for verification purposes.

- Fill out the one-time password that you received on the registered mobile number.

- Finally, you will get a message in green saying, “Your User Id for Internet Banking is: DFxxxxFxx8”

You can use this user ID, and the process is complete. Make sure to write down the user ID somewhere, or you can create a contact on your phone with any title and save the username.

How to Register for PNB Net Banking? – For Corporate Users

Setting up PNB net banking for a corporate user is relatively easy. Visit www.pnbindia.in and click on the Internet banking option. You can choose between the retail and corporate user options on the following page. Then, click on the corporate internet banking option here.

Once you hit Corporate Internet Banking, you will get the option to log in. So, you might be wondering where the choice is to set up a new user. Well, you can do it by visiting a local branch.

You can learn about the corporate user ID from the local branch and get a password. This password is valid for one-time use; you will need to change it. Thus, use the User ID and password for one-time login to set a new password. Then, follow the previously given step to log in and fill out all the details.

Once you have entered the corporate ID and user ID, you can choose the login type to be general and enter the password to complete the process.

Important Note: Admin of the corporate account get the one-time password in the message, and after the first login, the user has to fill out seven security questions for future recovery purposes.

PNB Password Reset – For Retail and Corporate Users

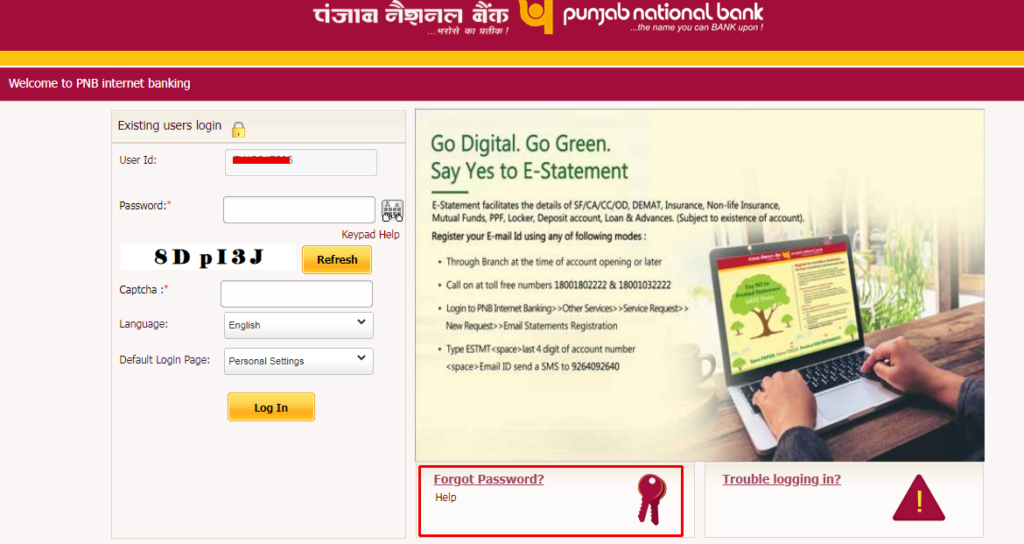

Once you visit the PNB website, you can find the login page and head to the “Retail or Corporate” Internet banking option. On this page, enter your user ID and hit continue. Then, click the forgot password option below instead of filling out any password.

Once you hit the “Forgot Password” option, a new page will load to fill in the required details. Enter your User ID and your date of birth or pan card number. Click submit button after that, and you will receive an OTP. Enter OTP and click submits.

Enter your bank account number and click verify. Next, you can find a new page asking for a debit card number, linked account number and ATM pin. After that, create a strong password, and you are ready to login into your account.

How to Login Into PNB Online Net Banking? – A Quick Guide

Even though we have learned the complete method to register for net banking for retail and corporate users, signing up is the first half of this job. After that, you should know how to log in and use PNB online net banking features. So, jump to the PNB official website and log in to understand.

- Visit www.pnbindia.in and click on the Internet Banking option.

- Choose retail or corporate banking based on the use.

- Once the new page opens, enter your user ID and hit continue.

- The users need to fill out their password and a captcha.

- You will receive an OTP to log in. Fill in the one-time password, and you are good to go.

- The first-time users have to answer seven security questions out of fifty.

Take your time and fill out the security questions. Remember that you can answer more than seven questions, so if you forget any of the answers, you still have the option to answer others during security checkups.

As a default, the transaction facility is not turned on by itself. So, the user has to turn on the transaction setting up a new password for the same.

Enable Online Transaction for PNB Net Banking

You must use a laptop or PC to enable online transactions for PNB net banking because it can make things quick and easy.

- Visit the PNB website and click on Enable Transaction facility option on this page.

- A new page will load up asking for user ID and DOB.

- Fill in both details and click on Submit button.

- Once this process is complete, you will get an OTP.

- Fill out OTP and set up your transaction password after the same.

The process is complete, and you can use the transaction facility from the PNB website. Ensure you don’t use the same password for a transaction you created to log in to the account.

Fund Transfer Method for PNB Online Banking

When you login into the PNB account from the official website, you can choose between different tabs depending upon the use case. You can select the transaction, general use, and more during login.

Once you are logged into the account, you can click on the transaction button and choose the version. If you haven’t added any beneficiaries, you can do it by adding one. Setting up a new user for NEFT or RTGS transfer will take a little while.

Remember that there is a small transaction fee based on the amount. You can avoid this transaction fee with the NEFT transfer method, but it will take a little while. NEFT does work during bank holidays, but the transaction process is during the banks’ working hours.

Bonus Things That You Can Do With PNB Online Banking

PNB offers a wide range of services with the PNB one application, and you can avail a wide range of advantages. However, the same you can expect from PNB net banking functionality. Below given are some common uses –

- Setting up a debit card password by getting a green pin on the registered mobile number.

- Customers can pay their credit cards, utility bills, and much more.

- Transact RTGS of 5 lakh rupees with a minimal charge of 40 INR + GST.

- Customers Can enable and disable debit cards for safety and security purposes.

These are some common uses that make PNB online net banking highly reliable. Therefore, the chances of facing any major issue after completion of the whole setup are negligible.