Objective | Achievement | Construction | Financial Progress | Overview | ISSR | CLSS | Affordable Housing | Enhancements | Guidelines | Criteria | Application Process | Application Status | Calculator | Banks | Latest Updates | Union Territory | FAQs

Although there were initial hiccups, the Pradhan Mantri Awas Yojana Housing For All Urban Scheme launched in June 2015 managed to pick up pace in 2019.

Throughout this article, we will examine the furtherance of Housing For All Urban in India.

PMAYU, known as Pradhan Mantri Awas Yojana Urban Housing For All Scheme, was launched by the Government Of India in June 2015. As the name implies, this scheme focused on the country’s urban areas. The scheme now covers about 4,000 cities and towns.

It was designed to aid the Central Government and the local authorities in implementing the scheme across India’s Union and state territories.

This scheme provides a:

- 6.5% of interest subsidy to the Lower Income Group and the Economically Weaker Section of the society

- 4% interest subsidy to Middle Income Group I

- 3% interest subsidy to Middle Income Group II

For housing loans taken by the eligible applicants under the Credit Linked Subsidy Scheme (CLSS) for 20 years.

Under the Pradhan Mantri Awas Yojana Urban Scheme, houses will be built using eco-friendly technology, with a preference for the ground floor given to older people and people with disabilities.

Currently, 1.05 crore houses have been sanctioned under the Pradhan Mantri Awas Yojana Urban Scheme to provide affordable housing to poor people in urban areas.

Also, read about PMAY application Status!

Key Features And Objectives Of PMAY-HFA Urban

Following are Pradhan Mantri Awas Yojana Housing For All Urban Scheme’s Key Features And Objectives

- Applicants are eligible for an interest subsidy of 6.5% on housing loans based on their income.

- A loan under PMAY U can be obtained by the beneficiaries to construct a house or to purchase a resale home.

- The tenure of a Housing loan under this scheme is up to 20 years.

- This scheme gives priority to women beneficiaries.

- Construction of houses is done using eco-friendly technologies.

- PMAY beneficiaries are eligible for PMAY until a cut-off date is determined by the States/Union Territories (UTs).

- Pradhan Mantri Awas Yojana Urban’s Beneficiaries must have a Bank Account Number, Permanent Account Number (PAN card), and an Aadhaar Card Number.

- The houses will not be considered complete under the PMAY U Scheme until the necessary infrastructure, such as power supply, water supply, drainage, and sanitation, is in place.

- Geotagged photographs will be used for tracking the progress of the houses under Pradhan Mantri Awas Yojana Housing For All Urban’s BLC component.

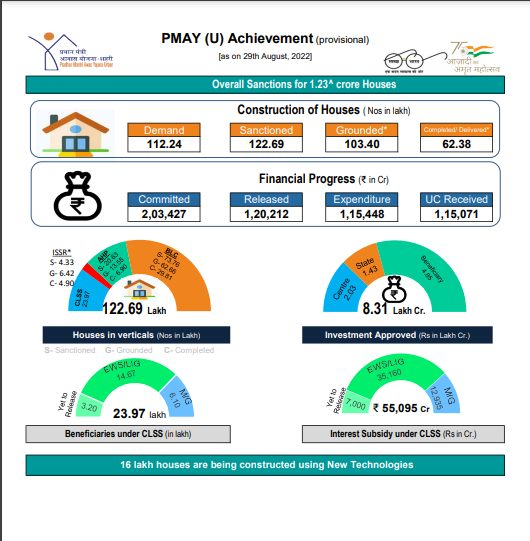

Achievement Report Of PMAY-HFA Urban [August 2022]

As you can see, under the PMAYU Scheme, 1.23 Crore houses have been sanctioned.

If we talk about the Construction Of Houses on 1st August 2022

- There was a demand for 112.24 lakh houses in urban areas.

- Out of which 112.63 lakh houses were sanctioned.

- 102.59 lakh houses were grounded.

- And a total of 61.77 lakh houses were completed and delivered.

Now, if we talk about the Financial Progress Of Houses on 1st August 2022

- The amount of RS 2,03,427 crores have been committed.

- The amount of RS 1,20,130 crores has been released.

- The amount of RS 1,13,770 crore has been used for expenditure.

- Utilisation Certificates Received is RS 1,13,354 crore.

An overview of the PMAY-HFA Urban Various Components

Below is a list of PMAY U’s various components

In-situ Slum Redevelopment (ISSR)

- In this component, the Government Of India aims to rehabilitate the slum land by partnering with Private firms to provide households to families living in such slums.

- The Central Government will make the price determination (of the house).

- And the beneficiary contribution will be determined by the State Government/Union Territory.

- Each eligible house will receive a Rs 1 lakh rehabilitation grant.

Credit Linked Subsidy Scheme (CLSS)

- The Second component of the Pradhan Mantri Awas Yojana Urban Scheme is the CLSS, in which the Government of India provides subsidies on interest rates to its beneficiaries.

- The subsidy interest rate varies depending on the group.

Here’s a nutshell explanation through this table

| Categories | Economically Weaker Section | Lower Income Group | Middle Income Group I | Middle Income Group II |

| Duration Of Scheme | 17th June 2015 To 31st March 2022 | 17th June 2015 To 31st March 2022 | 1st January 2017 To 31st March 2021 | 1st January 2017 To 31st March 2021 |

| Income Of The Households | Up Till RS 3,00,00 | RS 3,00,000 To RS 6,00,000 | RS 6,00,000 To RS 12,00,000 | RS 12,00,000 To RS 18,00,000 |

| Subsidies Interest Rate | 6.5 Percent (per annum) | 6.5 Percent (per annum) | 4 Percent (per annum) | 3 Percent (per annum) |

| Tenure Of The Loan | 20 Years | 20 Years | 20 Years | 20 Years |

| The Maximum Amount of Loan Entitled to Subsidies | RS 6,00,000 | RS 6,00,000 | RS 9,00,000 | RS 12,00,000 |

| Maximum Adobe Unit Carpet Area | 30 Square metre | 60 Square metre | 160 Square metre | 200 Square metre |

| Calculation Of Subsidies Interest Rate Through NPV | 9% | 9% | 9% | 9% |

–

Affordable Housing in Partnership (AHP)

- Through this component, public and private partners will collaborate to construct housing for the Economically Weaker Section category.

- The Government Of India will provide aid of Rs 1.5 lakh per house.

- If the project offers at least 250 houses and at least 35% of the housing is for the Economically Weaker Section category, assistance will be provided by the Central Government.

Beneficiary-led individual house construction/enhancements (BLC)

- Under this component, aid is provided to the families of beneficiaries who cannot avail of the benefits from the abovementioned components.

- Central aid of RS 1.5 Lakhs is being provided to the families of beneficiaries who fall (part) under the Pradhan Mantri Awas Yojana Urban Housing For All Scheme.

- The advantage of this component can be taken by beneficiaries only when the existing house can be extended by no less than 9.0 square meters.

- Kuccha or Semi pucca houses of beneficiaries can be re-developed through this component.

Guidelines And Eligibility Criteria For PMAY-HFA Urban

To be eligible for this scheme, you must adhere to these guidelines and meet the necessary criteria:

- No pucca house can be owned by either the beneficiary or his family in the country.

- A married couple or joint owner will receive one subsidy.

- The beneficiary shouldn’t have received any housing benefits in the past.

- Aadhar cards must be provided by the beneficiary and his family while applying for the loan.

- An unmarried son or daughter, as well as the beneficiary’s wife, comprises the beneficiary’s family.

Criteria

| Categories | Income Of Households |

| Economically Weaker Sections Of Society (EWS) whose income is up to | RS 3,00,000 |

| Low Income Group whose income is up to | RS 3,00,000 To RS 6,00,000 |

| Middle Income Group-I, whose income is up to | RS 6,00,000 To RS 12,00,000 |

| Middle Income Group-II, whose income is up to | RS 12,00,000 To RS 18,00,000 |

Application Process Under PMAY-HFA Urban

The following steps will guide you through the PMAY-Urban application process:

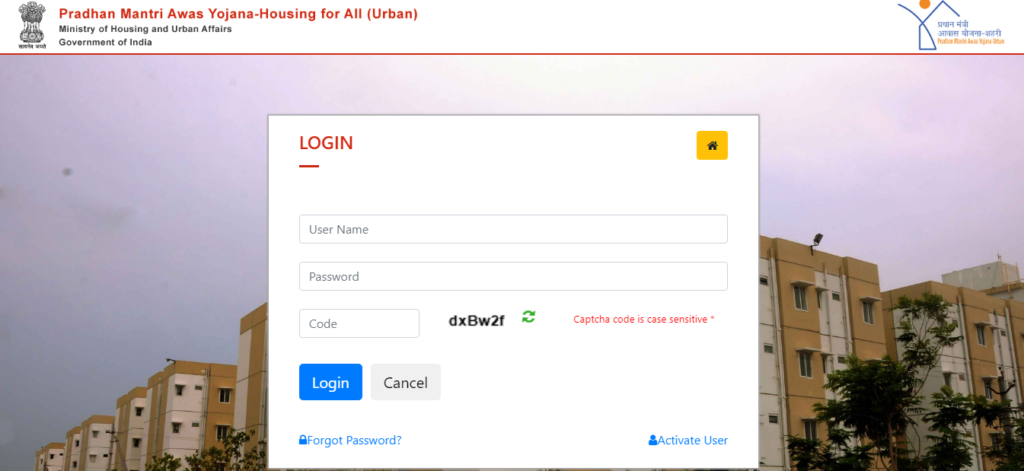

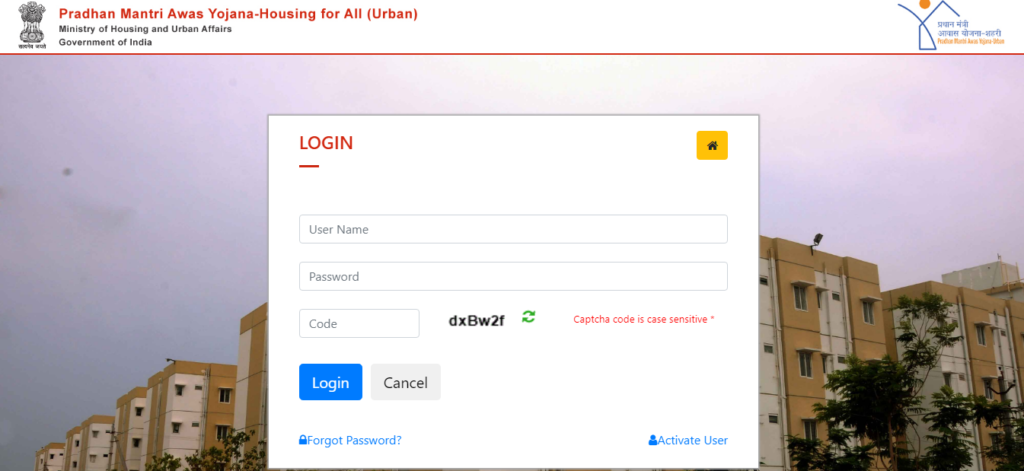

- The candidate has to visit the Official Website of Pradhan Mantri Awas Yojana Urban, where they have to log in their details.

- After logging in, click on the Citizen Assessment option on the homepage.

- After clicking, choose either from “Slum Dweller option” or “Benefit Under Other 3 Components”.

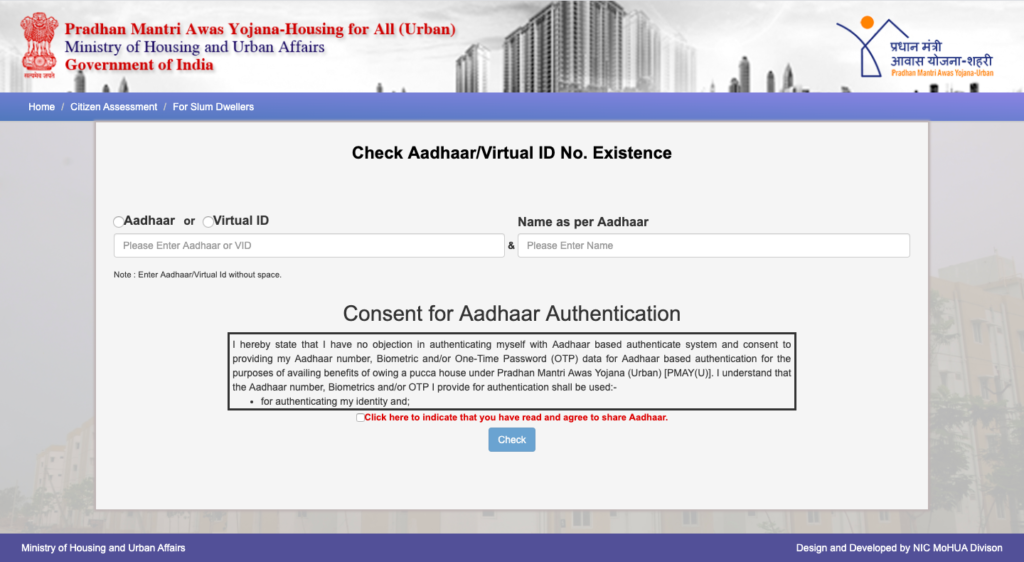

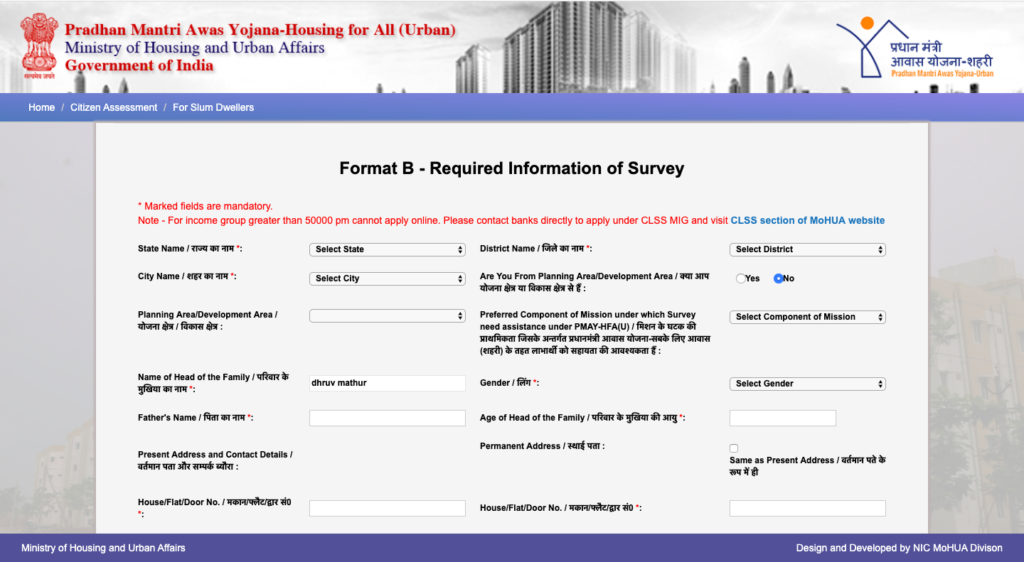

- After choosing any one option, you will be redirected to a new page where you will be asked for your Virtual ID Number or Aadhar Card Number.

- Input your details and make sure the details you are mentioning are authentic; otherwise, your application will be called off.

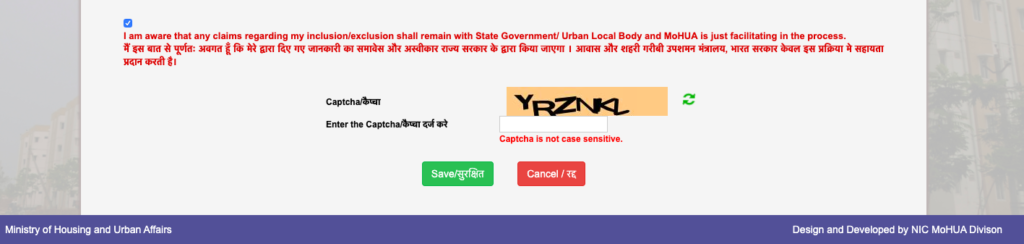

- After furnishing all the details, fill in the captcha code given and hit on to the submit button.

How To Keep Track Of Your PMAY-HFA Urban Application Status

Your query can be answered by following the steps below:

- The beneficiary must log in to the Official Website of Pradhan Mantri Awas Yojana Urban.

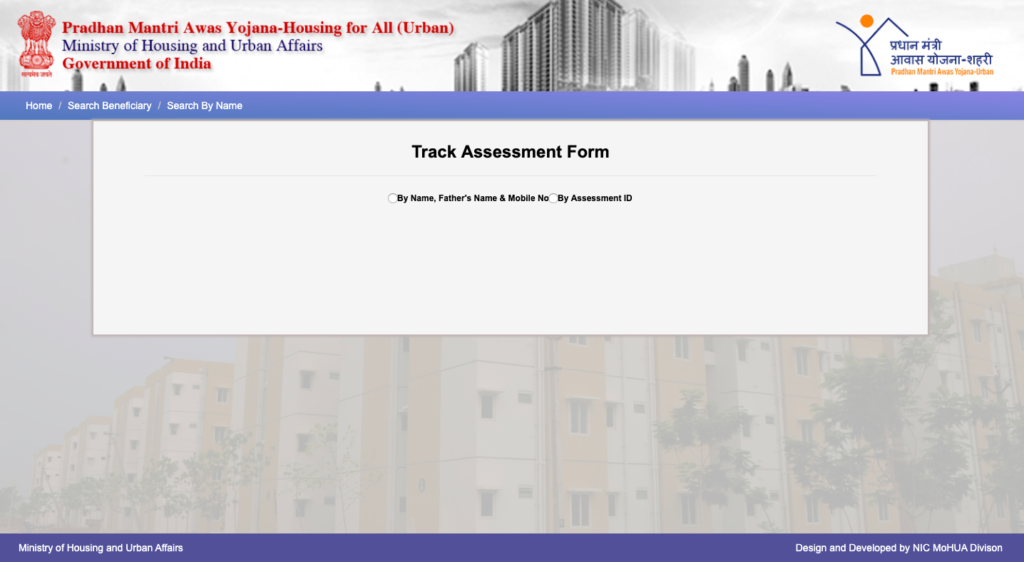

- Go to the Citizen Assessment option on the homepage, where you will find an option to Track Your Assessment Status.

- Upon clicking the option, the beneficiary will be prompted to enter their registered mobile number or father’s name.

- Input the details and hit the submit option; your device will show your application status.

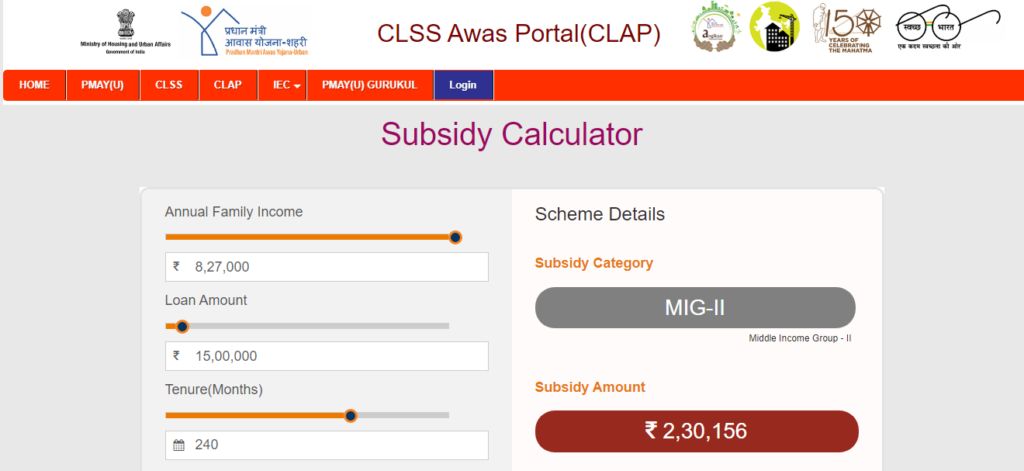

An Interactive Calculator To Calculate Subsidy Under PMAY-HFA Urban

- The beneficiary must visit the PMAYU-HFA Scheme page.

- The beneficiary should input the following information:

-Mention your annual family income

-Input the loan amount

-Input the tenure period

-Answer the question “Is this your first pucca house?” by choosing from Yes or No

- Once the details are provided, press the ‘Calculate’ button.

- It will show you how much subsidy you will receive on your loan amount.

Top 10 Banks offering Home Loans Under PMAY-HFA Urban

The top 10 banks in India which offer loans under the PMAY scheme are listed below:

- Bank of Baroda

- State Bank of India

- Axis Bank

- IDFC First Bank

- Bandhan Bank

- Bank of India

- HDFC Bank

- IDBI Bank

- Punjab National Bank

- Canara Bank

Latest Updates On Pradhan Mantri Awas Yojana Urban Housing For All Scheme (PMAYU-HFA)

- The Government Of India launched the Pradhan Mantri Awas Yojana Urban Housing For All Scheme in June 2015, intending to construct a total of 1.12 crore residential units by the end of 2022.

- On 17th August 2022, the Cabinet Minister approved prorating the scheme until 31st December 2024 to ensure the speedy completion of houses under the PMAY-Urban Scheme.

- Following the most recent government reports, 112.63 lakh houses were sanctioned, 102.59 lakh houses were grounded, and 61.77 lakh houses were completed and delivered.

States/Union Territory Progress Under PMAY-HFA Urban

| Physical Progress Of Houses (NOs) | Physical Progress Of Houses (NOs) | Physical Progress Of Houses (NOs) | Financial Progress (RS IN CRORE) | Financial Progress (RS IN CRORE) | Financial Progress (RS IN CRORE) | |||

| Name Of the State & Union Territory | Project Proposal Considered | Sanctioned | Grounded | Completed/Delivered | Investment | Sanctioned | Released | |

| States | Andhra Pradesh | 1,203 | 20,71,776 | 19,21,824 | 5,82,717 | 88,685.56 | 31,555.35 | 14,223.58 |

| States | Bihar | 520 | 326546 | 307781 | 96092 | 18329.26 | 5165.61 | 2544.76 |

| States | Chhattisgarh | 1796 | 301781 | 254123 | 148380 | 13313.86 | 4755.72 | 2899.23 |

| States | Goa | 10 | 3097 | 2867 | 2865 | 657.98 | 72.21 | 67.72 |

| States | Gujarat | 1717 | 1054790 | 874321 | 737945 | 106172.84 | 21060.84 | 15256.81 |

| States | Haryana | 457 | 165427 | 87948 | 53256 | 15510.32 | 2944.68 | 1349.18 |

| States | Himachal Pradesh | 308 | 13053 | 12625 | 7876 | 863.33 | 235.81 | 172.41 |

| States | Jharkhand | 453 | 234114 | 209897 | 112612 | 11541.54 | 3682.33 | 2520.23 |

| States | Karnataka | 2760 | 700578 | 591102 | 273962 | 51193.35 | 11493.56 | 5407.70 |

| States | Kerala | 699 | 157430 | 128878 | 102396 | 8270.76 | 2611.60 | 1832.43 |

| States | Madhya Pradesh | 1853 | 958100 | 858671 | 520939 | 52506.62 | 15709.71 | 11671.14 |

| States | Maharashtra | 1556 | 1634553 | 869405 | 639232 | 190648.19 | 28620.19 | 13916.70 |

| States | Odisha | 976 | 212950 | 161531 | 108615 | 9727.56 | 3350.97 | 1885.86 |

| States | Punjab | 871 | 111896 | 100430 | 55042 | 7977.06 | 1986.21 | 1294.36 |

| States | Rajasthan | 422 | 266692 | 630336 | 137516 | 21857.38 | 5039.92 | 3313.22 |

| States | Tamil Nadu | 4708 | 691236 | 235413 | 463030 | 48598.21 | 11257.92 | 8591.22 |

| States | Telangana | 303 | 247079 | 1529132 | 210079 | 30099.27 | 4396.03 | 3044.09 |

| States | Uttar Pradesh | 4536 | 1714013 | 39775 | 1140483 | 83785.89 | 26978.71 | 19340.62 |

| States | Uttarakhand | 243 | 66473 | 39775 | 24991 | 5289.01 | 1209.46 | 636.35 |

| States | West Bengal | 656 | 693436 | 489722 | 283839 | 37500.52 | 11070.19 | 5582.14 |

| Sub-Total (States) | 26047 | 11325020 | 9475968 | 5701667 | 802528.52 | 193197.02 | 115549.76 | |

| North East States | Arunachal Pradesh | 61 | 8999 | 8243 | 3358 | 510.70 | 189.84 | 143.13 |

| North East States | Assam | 441 | 161309 | 155514 | 54229 | 4884.85 | 2441.23 | 115.92 |

| North East States | Manipur | 45 | 56029 | 45429 | 6481 | 1445.21 | 841.11 | 337.13 |

| North East States | Meghalaya | 36 | 4752 | 3648 | 902 | 185.29 | 72.08 | 24.95 |

| North East States | Mizoram | 52 | 40452 | 35623 | 5330 | 917.31 | 618.81 | 204.60 |

| North East States | Nagaland | 75 | 32335 | 31950 | 8027 | 1050.01 | 511.02 | 306.97 |

| North East States | Sikkim | 11 | 701 | 562 | 179 | 34.26 | 11.88 | 6.41 |

| North East States | Tripura | 122 | 94289 | 80689 | 60117 | 2948.44 | 1512.97 | 1091.21 |

| Sub-Total (North Eastern States) | 843 | 398866 | 361658 | 138623 | 11976.07 | 6198.92 | 3273.33 | |

| Union Territory | Andaman & Nicobar (Union Territory) | 2 | 378 | 377 | 45 | 95.74 | 5.87 | 1.97 |

| Union Territory | Chandigarh (Union Territory) | – | 1194 | 1129 | 1129 | 253.29 | 27.13 | 25.56 |

| Union Territory | Union Territory Of DNH & DD | 9 | 10011 | 8789 | 6370 | 848.33 | 210.26 | 164.95 |

| Union Territory | Delhi (NCR) | – | 28449 | 27288 | 27288 | 5444.16 | 653.44 | 624.76 |

| Union Territory | Jammu & Kashmir (Union Territory) | 403 | 48832 | 46656 | 14466 | 2666.48 | 750.03 | 363.50 |

| Union Territory | Ladakh (Union Territory) | 8 | 1363 | 1071 | 596 | 67.73 | 31.05 | 22.15 |

| Union Territory | Lakshadweep(Union Territory) | – | – | – | – | – | – | – |

| Union Territory | Puducherry (Union Territory) | 45 | 16039 | 15632 | 6845 | 901.61 | 252.43 | 167.64 |

| Union Territory | Subtotal (Union Territory) | 467 | 106266 | 100942 | 56736 | 10277.3 | 1930.22 | 1370.53 |

| GrandTotal | 27357 | 121.30 Lakhs | 103.40Lakhs | 62.38 Lakhs | 8.25 Lakh Crore | 2.01 Lakh Crore | 1.20 Lakh Crore |

Out of total 122.69 lakh houses approved and allotted as on 31.3.2022, around 1.4 lakh non-starter homes have been curtailed by some States against which States to put up new proposals by August 2022.

सबका सपना, घर हो अपना

Frequently Asked Questions

Can I apply for Pradhan Mantri Awas Yojana Urban Housing For All Scheme if I own an unconstructed plot?

Yes, people with an unconstructed plot can avail the benefits and apply for Pradhan Mantri Awas Yojana Urban Housing For All Scheme.

When did Pradhan Mantri Awas Yojana Urban Housing For All Scheme (PMAYU-HFA) come into existence?

The Government Of India launched this scheme on 25th June 2015.

Would it be possible for me to apply for more than one income category under the Pradhan Mantri Awas Yojana Urban Scheme?

The scheme’s benefits can only be accessed by one income category.

Can I apply for PMAY-Urban if my parents own a house?

Let’s say that you fall into the income category described above.

In that case, Pradhan Mantri Awas Yojana Urban applies despite your parents owning a house. This is because both adults earning income are considered separate households. However, you should not own a pucca house anywhere else.