About IGRS | Essentials | Deed & Stamps | Registration Charge | Stamp Duty | Tax Calculation Factors | Ladies’ Stamp Duty | Documentation | Tax Payment | Property Registration Process | AP receipt | Land Registration | Market price | IGRS AP Portal | EC Details | Possessions | Conclusion

About IGRS AP

Inspector General of Revenue and Stamps province (IGRS Andhra Pradesh) collects revenue for the state via stamp tax, registration charges, and transfer duty. Enrollment of documents with IGRS is essential as once documented, they become public notification, thus making it easy for authentication.

IGRS imposes a tax on property acquisitions and transfers, and a registration fee is levied on the transfer of ownership of the immovable property at IGRS. It is Andhra Pradesh’s most geriatric department that has the authenticity of the filed records. The official website of IGRS AP rs.ap.gov gives the AP stamps and registration EC.

Essentials to Apply on IGRS AP

In order to apply for AP EC compositions and search for IGRS AP EC, you will need property registration documents, sale deeds, deeds, and proof of your address. An online search for an Encumbrance Certificate can be conducted with either a document or memo number. This article focuses on the details of the IGRS AP EC-encumbrance certificate, which will assist property owners in accessing all of the components in one location.

The article focuses on the importance and advantages of IGRS AP EC and procedures linked to IGRS EC, like the way to seek your IGRS EC AP encumbrance certificate, download your encumbrance certificate, and apply for IGRS EC encumbrance certificate. It also includes other services by IGRS stated within the article.

Besides finding IGRS deed details, EC Andhra Pradesh, AP stamps, and registration. IGRS CC Andhra Pradesh, property valuation-IGRS market price AP, list of notaries. Citizens in the state can avail of many other services using the IGRS AP portal.

Suppose you’re buying any immovable property, including a flat, land, or building in the state. In that case, you wish to pay taxation on the transaction, register the document with the AP land registration and property department, and have all the AP stamps and registration deed details.

Other Essential Details

You should register every sale of immovable property under the Indian Registration Act, 1908, under section 17 within the Registrar’s office within six months of deed execution. Property registration helps preserve the ownership title and acts as a symptom if you lose the property documents.

The department will collect transfer duty in addition to tax and registration fees when you are registering property. This is in addition to the costs for registering the property itself. Both the Andhra Pradesh Gram Panchayats Act from 1964 and the Andhra Pradesh Municipalities Act from 1965 are not violated by this provision.

To move on with the registration process, the client and the seller must appear in person at the SRO office, where the department locates the property. Additionally, there needs to be a minimum of two witnesses for the technique.

The emblems and enrollment at the AP department take up AP registration of around 5k to 6k properties daily. Closely, the department has done 17 lakh to 18 lakh AP registration possessions and AP land enrollments.

IGRS AP deed details – Stamps and Registration

You can look up information on AP stamps and the registration act on the website.ap.gov.in, where you can also check your enrollment status. Online submission of AP land registration paperwork or AP property registration documents is how the department completes the land or property registration process, which can be done electronically.

Before continuing with the AP land registration process, the client, the seller, and two witnesses must go to the sub-office, the registrar’s, where they will look for the property in question.

The AP land and property registration office currently offers various services online, including AP land registration, and shares information on AP stamps and registration deed details. Here is a way to use these services to induce information on IGRS AP deed details.

Note that visible of the Coronavirus pandemic, all the data shared on the state Property and AP Land Registration website may reach http://registration.ap.gov.in/ regarding stamps and registration AP including AP registration value is updated, and no physical visit to the office is required by citizens.

What is the Registration Charge?

While revenue enhancement may be a fee that states charge supported the transaction value, the registration charge is the cost users acquire the service of putting a contract or a deed within the government’s records. Simply put, the government reciprocally maintains a registry of documents for a fee.

To a reasonable extent, this process lends inviolability to papers that will otherwise not be legally binding. The Indian Registration Act, 1908, details how the registration of documents should happen.

What is Stamp Duty?

When a property is sold to a new owner, the government imposes a tax on both the seller and buyer. The purpose of this tax is generally thought to be revenue enhancement. Transactions involving residential and commercial properties and freehold and leasehold assets are subject to this tax.

Because states impose their own taxes, the speed limit varies considerably from one jurisdiction to the next. The stamp mark on documents is that witness that the paper has assumed permission of the authorities and now bears legal validity. Hence, the levy got its name from the stamp mark appearing on documents.

Factors Considered for Stamp Tax Calculation.

The stamp tax % depends on several factors, such as:

- The property’s location: City region, metropolitan area, and rural Revenue enhancement are different for properties falling within the municipal limits of a city compared to those falling outside the bounds. Within the case of the previous, charges are always higher.

- Age of the owner: In some states, discounts could also be available for senior citizens.

- Gender of the owner: Few regions also offer settlements for female land owners.

- Usage of property: Whether it’s for commercial use or residential use. The taxation in the case of business properties will always be beyond the tax on residential flats.

- Type of possessions: Flat or a separate house.

- Project indulgences: States like Uttar Pradesh charge additional tax if the housing development within which the unit is found offers high-end amenities like elevators, swimming pools, clubhouses, gyms, community halls, and sports areas.

Stamp Duty for Ladies

Several states charge lower taxes to market property ownership among women, just in case a home is registered under a girl’s name. Within the capital, as an example, women buyers pay only 4% as taxation in Delhi on property purchases, while the speed is 6% for men.

If the property is registered in both of their names as the significant co-owners, they are eligible for reduced rates. However, this discount is not available in every geographical area for ladies. For instance, in the Indian states of Kerala, Bihar, and Jharkhand, both men and women must pay the same fees. Additionally, under the stipulation that the property’s value must be under 10 lakhs rupees, female taxpayers are eligible for a one percent reduction in the taxation they pay.

Documentation Required for Payment of Taxes

Depending on the sort of property, the client will need to submit a spread of documents at the time of property registration for revenue enhancement payment. The client is required to supply some or all of the below-mentioned documents at the moment of enrollment:

- The sale agreement, Sale deed, Khata certificate

- Community share certification Photocopy and society enrollment credential as in case of the housing assignment.

- NOC from the apartment alliance, as in the housing project case.

- Sanctioned building plan for an under-construction property.

- Builder-buyer agreement for an under-construction property.

- Possession letter from the builder of an under-construction property.

- Title documents of the land owner as in case of land purchase)

- Records of Rights and Tenancy Corps or 7/12 extract just in case of land purchase.

- Conversion order in case of land purchase.

- Tax paid receipts for the last three months

- Registered development agreement as in the case of the joint development property.

- Power of attorney/s, if applicable.

- Cooperative development agreement between land owner and builder as in common development property. Duplicates of all registered deals as in case of a resale property.

- Latest bank statements just in case of any outstanding loan amount

- Encumbrance certificate

How is Tax Paid?

There are three methods to disburse the stamp tax: non–judicial stamp paper, franking method, and e-stamping method.

Non-judicial stamp paper method (or offline mode)

Under this technique, it mentions the contract details in the paper, and the executants sign it. After that, the stamp is registered at the sub-registrar’s office within four months. During this mode of taxation payment, the vendor should purchase stamp paper of the desired value from a licensed stamp vendor for his sale instrument if the worth of stamps doesn’t exceed Rs 50,000. Since property transactions nearly always involve more money than that, you have to purchase the required stamp paper from the treasury or sub-treasury of the regime.

Franking procedure

The department publishes the procedure and the contract in a simple paper. Then it submits the form to a licensed bank, which processes the records through an appliance. The authorized banks stamp the possessions acquisition composition or affix a denomination thereon for which the parties pay taxation for the transaction.

E-stamping

You’ll also pay the requisite revenue enhancement amount in many states online through RTGS/NEFT. After that, download the revenue enhancement certificate, with details like the date and taxation type for registration. The community has appointed the Stock Holding Corporation of India Limited (SHCIL) because of the agent for e-stamps from the nation. Shoppers can dwell the SHCIL portal to pay a surcharge on their possessions purchases.

Note: not all states have all three tax payment options available.

The Property Registration process

Mentioned is the step-by-step process for property registration in the province. Obtain all the crucial details and essential information required for stamps and registration AP under IGRS AP. Start with getting about the AP registration market price of the property. Check land value during a.P. in 2021, stamp duty, registration charges in state, and user charges applicable on different property types.

You’ll also calculate all the significant amounts of the various IGRS deed details (deed details AP) through this online calculator on the stamps and registration AP department. Next, check the vade mecum and compare it with the AP registration value. You will pay taxes worth higher than the 2. Once you determine the above details, please buy stamps with a non-judicial discount to proceed with AP registration 2022.

Process continuation

Once finished AP land registration documents are online, do the AP registration document download. Once you collect all the deed information on AP documents, visit the sub-registrar’s office under the stamps and registration AP department with all the stakeholders for property registration AP.

Based on the data given within the Public Data Entry System, the SRO will make a slot booking slip. Next, he does the E-KYC and organizes the registering parties’ fingerprint sites. He checks the fingerprint with the Aadhaar database. Once the fingerprint matches with the Aadhaar card, they charge the applicant with revenue enhancement, registration AP charges, and transfer charges.

Note that if there’s any discrepancy within the verification process, the customer/seller should make the requested changes, and then the registration process will continue. Finally, the SRO registers the compositions by accepting thumb appearances and si on the papers and registry. Next, as a part of the digital AP registration process, you need to scan and load the written document on the IGRS AP server, which the client will access.

Stamps and Registration AP receipt

For each property, land registration charges in AP have been paid for every Power of Attorney presented for authentication and every sealed cover deposited. An enrolling officer levies a fee or fine for each receipt of the form. The ticket for the enrollment AP document/ IGRS deeds details will hand over to the one presenting the document or his nominee after the person’s signature.

If the receipt for the charged land enrollment charges in AP is mislaid for a few reasons, the one that is required to supply it can sign a declaration of loss and request for creating another registration AP document receipt that may obtain by signing the counterfoil.

AP Land Registration – Anywhere

Residence consumers will now be able to enroll AP their possessions document in any sub-registrar office of the section. As per the new directives from the authorities, all sub-registrar offices within the same community will have concurrent jurisdiction and may register any property deed details within the district.

It implies that a property buyer can approach the SRO nearest his residence or office and obtain the registered IGRS AP deed details. There are around 38 communities where you can record AP your deed attributes of possessions or land.

AP Registration Market Price

Applicants can check the value of land in an exceedingly.P. in 2021 of non-agricultural and agricultural property online from the official portal of the Andhra Pradesh Land Registration and Property Registration department. Here’s a step-by-step guide to search out out AP registration market price or the AP stamps and registration value online:

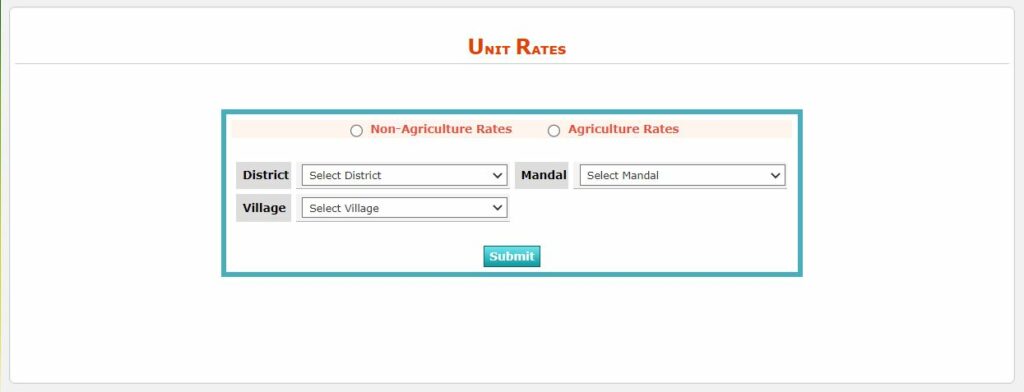

Step 1: For the AP registration market price, visit the Registration and Stamps Department of state portal.

Step 2: Press click on the AP enrollment ‘Market Value’ option on the left menu.

Step 3: The website redirects you to seek out AP stamps and registration market price to a replacement page on the AP stamps and registration website. Select the sort of property, district, Mandal, and village from the computer menu.

Step 4: The website displays the results of the market price AP on your screen.

Components of its Stamps and Enrollment Portal of IGRS AP

Ease of use: IGRS AP online portal is simple and offers many services. The IGRS AP portal offers many services under one outlet, and under the benefits, some subsections help the user get in-depth information. Some favored APIGRS services include GPA search, marriage registration, property registration, property valuation, market price certificate, and encumbrance certificate.

Registration: IGRS AP online portal includes the registration service with which a user can register himself with the AP stamps and registration department by creating a username and password. An APIGRS user needs to fill in details including user type, name, contact details including address and signaling, and identity details like Aadhaar card number. For registration.

Templates: IGRS AP, for the user’s convenience, has provided templates for the services they seek. Some IGRS AP include sale deeds, rent/leases, mortgages, and gift templates.

General lists: Under IGRS AP ‘Find section‘ available are lists that help find and go in touch thereupon office for using the service. These include –

- stamp vendor list,

- stamp-Franking machine vendor list,

- stamp-SHCIL vendor list,

- notary license holders list,

- chit fund companies list, and

- village directory.

Online FAQs: The IGRS AP portal provides online FAQs within the sort of chat.

Details on AP Stamps and Enrollment EC of IGRS

- IGRS EC AP or limitation credential AP has the possessions/land owner’s name.

- IGRS EC Andhra contains possessions attributes.

- Limitation certification AP will note the whole belongings in step with IGRS act attributes.

- The department identifies IGRS EC as having discussions with possessions.

- Exchanges identified with a property referenced within the IGRS EC.

- Hindrance credential AP will emphasize whether possession has been accepted using an equity acclaim line or any distinction.

- For apt acts, the department gives subtleties on acceptance compensation within the IGRS EC.

- Admission delivery act attributes on the IGRS EC Andhra.

- You can access EC online AP on IGRS AP or the Stamps and Registration AP website at registration.ap.gov.in EC.

- IGRS EC significance

- IGRS AP deed details provide EC with vital proof of property ownership.

- Banks ask IGRS EC AP as a guarantee to urge property credit. The IGRS EC AP document assures the financial organization that the property/land isn’t in the sale.

- If, for a few reasons, the property charge isn’t got quite three years to the AP stamps and registration department, IGRS EC AP needs to run to the Panchayat/Village officer to refresh the land charge records.

- IGRS EC is obligatory just in case of taking back PF buying and development of property

IGRS AP to Raise Digital Stamps and Online Charge for Possessions Enrollment

IGRS AP raises digital emblems for possessions enrollment at village/ ward secretariats, mentions a Deccan Chronicle report. An MOU inscribed between IGRS AP and SHCIL for digital emblems sale will encourage this technique.

IGRS AP also inscribes contracts with village/ward administrations, stamp merchandisers, and standard service centers for online stamps. Also, IGRS AP enhances transparency within the system. It will soon enable online payment of property registration charges at SCHIL centers. It is rather than paying through challans to bank document writers.

IGRS AP Deed Details – Conclusion

IGRS AP website offers various property-related services like viewing and downloading IGRS EC and inspecting the demand price. It also offers to figure and administer the expenditure of earnings enhancement and enrollment fees. The portal also assists in other citizen services like marriage and firm and association enrollment, which may access on registration.ap.gov.in.