IGRS | IGRS AP | Documents | Calculation | Services | Features | Search Details | Online EC | Information | Significance | Search EC AP | Verify Online | Procedure | Registration Process | Revision | AP receipt | Anywhere Registration | Charges | Certified Copy | Pay Stamp Duty | Market Value | Recompensation | Documents Required | Will Registration | Payment | EC Types | Latest News | Bottom Line | FAQs

The tax imposed on immovable property and legal documents is known as stamp duty. It is frequently necessary when transferring property or assets. After the state stamp duty is paid, the immovable property is registered with the Andhra Pradesh Property and Land department.

The stamp duty in Andhra Pradesh is as essential as in any other state in India for any property sale or a purchase transaction. The Andhra Pradesh Land Registration Department oversees the process and marketing. The buyer and seller must appear in person at the sub-office registrar’s in the respective district & jurisdiction of the property, accompanied by two witnesses.

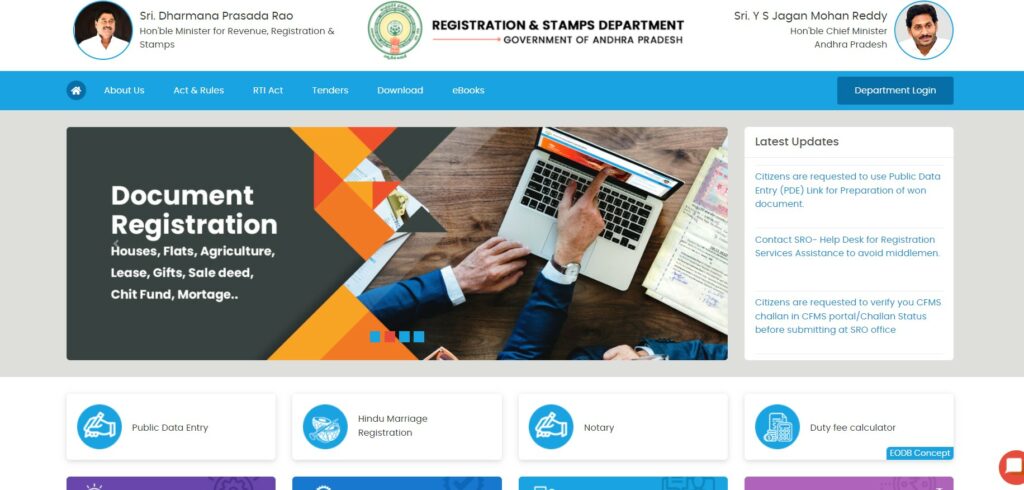

What is IGRS?

IGRS stands for Inspector-General of Taxes and Stamps. The governmental entity in charge of charging and collecting various property taxes is known as the IGRS. The IGRS is in charge of maintaining old and new public records and providing them as evidence in court in case of a property dispute.

The official name of Andhra Pradesh’s IGRS agency is IGRS AP. Through its official IGRS portal, registration.ap.gov.in, the IGRS AP provides its citizens with a variety of online AP stamps and registration services.

What is IGRS AP?

IGRS AP is the state of Andhra Pradesh’s oldest department to provide authenticity to registered documents. The department collects stamp duty and registration fees in addition to property registration. The state government must charge stamp duty on any sales or transfers of real estate. An entry fee is also imposed during the property registration process if the change of property or immovable property.

IGRS AP offers various online services, including data, marriage registration, market value services, and land registration. For more information, go to the IGRS Andhra Pradesh website at http://registration.ap.gov.in

Documents Required for Registration of New Property

The following documents are required to register a property with IGRS AP:

- Passport-sized photographs of the buyer and seller, as well as the buyer

- Aadhaar cards, voter ID cards, and passports are examples of identity cards.

- CSD issued a current property card (City Survey Department)

- Original sale deed registered photocopy

- Utility bill photocopy

- A duplicate of the valid document containing the stamp duty payment is required.

How it is Calculated?

To understand better, we use an example to show how to calculate stamp duty using IGRS AP deed information. The registration fee is 0.5 percent, and the relevant council tax is 5% if Ram spends Rs 69.5 lakh on a flat. A transfer duty fee of 1.5 percent will also be charged. Shyam will thus be required to pay income tax of Rs. 3,49,500 lakh ($70,00,000 * 5/100).

For AP deed data, the registration price is Rs 70,00,000*0.5/100, or Rs 35,000.

For AP deed information, the transfer duty cost is Rs 70,000*1.5/100 = Rs 1,04,996.

Shyam will therefore be required to pay Rs 4,90,000 or Rs 4.9 lakh for the AP stamps and registration. Shyam’s entire outlay on the property is Rs. 70 lakh plus these fees. Rs 4.9 lakh equals Rs 7,490,098 lakh, or Rs 74.99 lakh.

IGRS – Services Offered by AP stamps and Registration Department

Individuals who obtain the Encumbrance Certificate can use IGRS to access the following services.

- Company registration Property registration Society Registration

- The property’s market value

- Prohibited property information Payment of stamp duty & registration fees

- Learn about your Sub-Registrar Office for Hindu and special marriage registration.

- Chit fund company information

IGRS – Features of AP Stamps and Registration Portal

Below is a list of some of the main components of the IGRS AP web platform.

- Quick Register: Users can quickly register using the IGRS AP online portal to create their credentials. The client type, name, email, mobile number, Aadhaar number, and other details must be provided. And it only takes a few clicks to sign up.

- Easy to Use: The IGRS AP web platform is very user-friendly. For different categories of internet services, there are multiple areas. Users access their preferred service and instantly find what they need.

- An extensive range of online services is offered by the IGRS AP site, including valuations, GPA searches, marriage registrations, property registration, & document registration, among many others.

- Lists: Users can utilise the IGRS AP portal to search through various lists, including the Sub-Registrar offices list, Stamps Vendor list, Attorney List, and more, to identify the closest office for their requested service.

- Templates for Documents: The IGRS AP site offers several document forms, including ones for sale deeds, mortgages, gifts, rent/lease agreements, release deeds, and others.

Searching For Details of AP Land Registration?

If you are a buyer of real estate, you can examine the previous deed data AP or the land you wish to purchase to determine whether the seller’s paperwork is valid. Use the following techniques to locate IGRS AP deed data for AP land registration:

- Go here to visit the Andhra Pradesh Registration Department’s website and confirm the deed information for public documents about AP land registration.

- Once there, you may look for AP land registry document information on floor plans & apartment complexes by going to the Register Details page.

- To get the AP deed data, enter the region, Mandal, village, survey number, and building number on the stamp & registration page.

Online EC Andhra Pradesh

A common issue before or after purchasing any estate is financial or legal repayments on a specific property. The govt should have a diploma acknowledging that the land is free of any financial or legal arrears. That certificate is known as the “IGRS AP Encumbrance Certificate,” and it was issued by the Enrollment and Ticketing Division of Andhra Pradesh at the initiative of the AP State Government. Through this certificate, the property owner can ensure that his property is free of legal or monetary obligations.

Anyone with a property in Andhra Pradesh can obtain an Encumbrance Certificate offline and online. An Encumbrance Certificate can be obtained by visiting the Lieutenant Registrar’s Office or MeeSeva Center, where the property is registered. However, it is more convenient to get an Encumbrance Certificate online at http://registration.ap.gov.in/, the official website of the Andhra Pradesh Registration & Stamp Department. Other services include a record of transactions on the village directory, a stamp duty calculator, and unique assets.

Information on AP Stamps and Registration EC

Registration.ap.gov.in contains information on all AP stamps and registration deeds. To complete the property’s AP land registration, the buyer and seller must travel to the sub-office clerk’s office, where the site is situated, with two witnesses. This can be made successful online by having to submit AP land required forms as well as AP land registry documents.

Many services, including AP land registry and details on AP stamps and register deeds, are already offered online by the AP land register and property registration office. Follow these steps to access these services and learn more about IGRS AP deeds.

All of the information on the Andhra Pradesh Property & AP Land Registration website, which can be viewed at http://registration.ap.gov.in, has been updated due to the coronavirus outbreak. Citizens are not obliged to physically visit an office.

IGRS EC Significance

- The IGRS AP EC is vital proof of property ownership.

- Banks ask for IGRS EC AP as security to receive property credit. The financial institution is assured not to sell the property or land by the IGRS EC AP document.

- For the land charge records to be updated, IGRS EC AP must be supplied to the Village council officer if the property fee has still not been paid to the AP Stamps & Registration department for further than three years.

- In the case of taking back PF and developing property, IGRS EC is required.

EC AP

The AP registration site at registration.ap.gov.in provides access to the IGRS AP EC and the EC (Encumbrance certificate AP) search.

Please be advised that if the servers are busy or in the process of being migrated, you may not be able to use the EC searching AP or the AP EC search. To collect AP stamps & registration EC, you may be required to attend the necessary sub-office registrar (SRO) or receive the IGRS EC via the Written reply site, which also offers online EC AP.

However, you can typically access the IGRS AP EC services using the IGRS AP site. To proceed to receive online EC Andhra Pradesh, enter information such as the references ID, house number, or study number in an earning village and select the district & location of the SRO. Before 1983, you had to go through the SRO just for AP stamps & enrollment EC department to receive EC AP certificates.

Also, search EC AP

To look for Andhra Pradesh stamps & registration EC, go to the IGRS EC webpage. Next, click on the encumbered certification under Services (EC search AP). The AP EC encumbrance statement can be found at http://rs.ap.gov.in/APCARDECClient/. After reading the EC search instructions, you must click the submit button on this IGRS EC page. You will arrive at http://rs.ap.gov.in/APCARDECClient/ecSearchByDocAuto.jsp?distcode=&distname=&srocode=&sroname=&srocode=&sroname.

You may search for IGRS AP EC using neither a document nor a note. When doing an AP EC search using a document number, include information such as the document number. Also, the year the registration was registered, the SRO of the AP stamps, and the registration Ec division Captcha before submitting.

Last but not least, you must input your IGRA AP EC id, among other things, if you use the ‘none’ option to look for your IGRA AP EC. Type the captcha, followed by the city, apartment, or house number, then click submit.

How to Verify Online?

Step 1: To validate your online EC AP, go to the ‘Services’ section of the official IGRS EC website and click on ‘Verify EC.

Step 2: Enter the departmental transaction ID and press “Submit” to confirm the IGRS AP EC.

The Procedure of Property Registration in Andhra Pradesh

Check out the following steps for property registration in Andhra Pradesh:

- Step 1: Compile all required paperwork and deed information for Andhra Pradesh stamp duty & IGRS registration.

- Step 2: Establish the property’s market worth in Andhra Pradesh.

- Step 3: Determine the significant costs associated with the various IGRS aspects of the deed using an internet calculator. Or utilize the department of registration and stamps for Andhra Pradesh’s online calculator.

- Step 4: Complete the online property registration documents in Andhra Pradesh. Download the papers and all of the deed’s details.

- Step 5: With stakeholders, go to the sub-office registrar of the Andhra Pradesh registration & stamp department to register the property

- Step 6: Create a booking slip based on your preferred time slot.

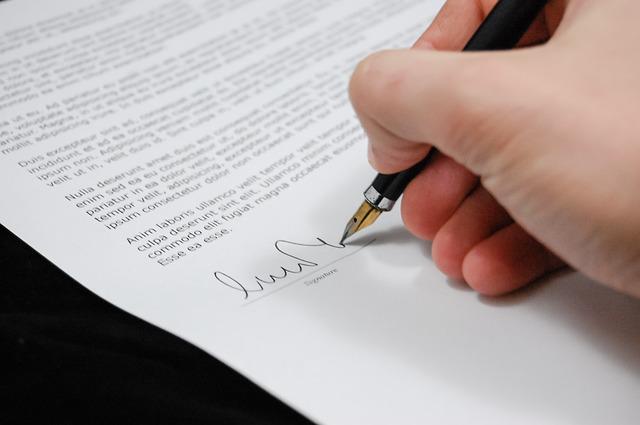

- Step 7: Present the IGRS detail of the deed to the sub-office registrar. And sign the Andhra Pradesh land registration document.

AP Stamps and Registration 2022 – Property Registration Process

The detailed procedure for Andhra Pradesh property registration is explained below.

- Obtain all required paperwork and deed information for stamps & IGRS AP registration.

- Discover a property’s AP registration market price first. Look into the Andhra Pradesh land market value, stamp duty, registration fees, and user fees for different property types in 2021. You can also utilise this online tool to determine the significant fees for the additional IGRS deed Information. The tool will be available in the stamp & registrations AP department (deed details AP).

- After that, look over the ready reckoner and contrast it with the market price for AP enrollment. The value you will pay sales tax will be the greater of the two values. Please buy non-judicial stamps once this has been established to move forward with AP certification 2022.

- Print the AP registration documents after completing the online AP land registration documents. Go to the sub-office registrar under stamps and enroll the AP department with all the participants for property registration AP. You can do this once you have gathered all the deed information AP papers.

Other Details

- SRO will create a slot booking slip based on the information entered into the Open Data Entry System.

- The E-KYC is completed, and the SRO collects the registering parties’ fingerprints. The thumbprint will be validated against the Aadhaar database.

- When the fingerprint matches on the Aadhaar card, the applicant is charged stamp duty, enrollment AP charges, and transfer charges. If there’s any discrepancy in the validation process, the buyer or seller must make the requested changes. The change must be done before the registration process can continue.

- Finally, the SRO registers the documents by trying to take thumb imprints and signatures on the records and registry.

- The registered file will be scanned as part of the digital AP enrollment process. It is also loaded on the IGRS AP server, which the buyer can access.

Revision of Guidelines

In July of 2021, IGRS Andhra Pradesh announced it will delay revising the IGRS AP market value of the movable property. This is until March 31, 2022, which is contrary to GO RT No. 404 since the modification was due on August 1, 2021. Due to the chaos produced by the Coronavirus flu outbreak, this occurred.

IGRS Andhra Pradesh has asked for objections to the 2020 IGRS market rate AP modification. To object to the IGRS market value AP, get in touch with the sub-registrar. However, the appropriate forms are available for download at APIGRS. From the drop-down menu, choose the district & sub-registrar desk, then press the APIGRS “Submit” button. It will upload the required form.

About AP Receipt

Each time property registration fees have been paid in AP. It is for each Attorney that is validated and for each sealed cover that is inserted. Each charge or fine assessed by a registering officer should be accompanied by a receipt from the AP land registration office. This is the department’s bill for registering AP document/IGRS deed data. They will provide the information to the submitter. Or his designee following signature by the individual in attendance.

Let’s say that, for some reason, the bill for the reimbursed registered land costs in AP gets lost. In that situation, the individual is required to provide. It may sign a loss document and ask for another registered AP document receipt. This is what you may acquire by signing the cover sheet.

Registration From Anywhere

Any district sub-registrar office can now register homebuyers’ property documents. New regulations from the state government stipulate. According to them, all sub-registrar offices within the same neighbourhood will have identical jurisdiction. In addition, they will be able to record any local real estate deed information. This means that a homebuyer can register the IGRS AP deed data at the SRO that is most convenient for them.

AP Stamps & Registration Charges

| Description | AP Registration fee | Stamp duty | User charges |

| Sale deed | 1% | 5% | Rs 100 if the amount is under Rs 50,000 Res 200 if the price exceeds Rs 50,000 |

| Gift deed | 0.5% (minimum Rs 1,000 and maximum Rs 10,000) | 2 % on IGRS market value AP | Rs 100 if the value is less Rs 50,000 Rs 200 if the sum exceeds Rs 50,000 |

| Agreement of sale-cum-general power of attorney | Rs 2,000 | 5% | Rs 100 if the amount is under Rs 50,000 Rs 200 if the amount is over Rs 50,000 |

| Sale with possession | 0.5% | 5% | Rs 100 if the amount is fewer Rs 50,000 Rs 200 if the amount is greater than Rs 50,000 |

| Partition | Rs 1000 | 1% | Rs 100 if the value is fewer Rs 50,000 Rs 200 if the sum exceeds Rs 50,000 |

| Settlement deed | 0.5% | 2% | If the amount is less than Rs 50,000, the fee is Rs 100. If the value exceeds Rs 50,000, the fee is Rs 200. |

| Mortgage with possession | 0.10% | 2% | Rs 100 |

| Mortgage without possession | 0.10% | 0.50% | Rs 100 |

Other details

You can register AP with information about your property or land deed in one of 38 districts. There are state-specific stamps and registration costs. According to the AP stamps and registration department, the current stamp duty is 5% of the property’s value. In addition, the AP registration fee is 1% of the property’s cost. The IGRS AP levies transfer duty at 1.5 percent of the purchase price of the property. This came about as a result of the AP Municipality Act of 1965 and the AP Gram Panchayat Raj Act of 1964.

States in India charge home buyers stamp duty to change the property title and transfer it to the buyer’s name via AP stamps and registration. The AP enrollment charge is the additional amount they must pay to the IGRS in addition to the stamp duty for the homeowner’s AP registration. It is a type of document fee.

Certified Copy of Registration Document

To get a certified copy of the registered AP document, use this service online for AP land registration records. You may access it by going to https://onlineap.meeseva.gov.in/CitizenPortal/UserInterface/Citizen/Home.aspx via the MeeSeva online portal. This is to get a duplicate of the SRO-completed AP land registration paperwork. As a supporting document, this deed details certification aids citizens in settling any legal difficulties about the AP land registration and property.

Payment of Stamp Duty in Andhra Pradesh

- Individuals can pay their stamp duty using one of three methods: submission of stamp paper, franking, or e-stamping.

- Stamp Paper, Franklin, and e-Stamp from Andhra Pradesh

- Individuals using this method can use payment methods such as demand draft, credit/debit card, cash, etc.

- You must pay stamp duty fees at an authorised franking machine in case of a franking device. The stamp vendor & franking machine can be found on the IGRS Andhra Pradesh website.

- Find the payment section on the homepage of the official website of Andhra Pradesh stamp duty and click on the vendor list. After that, you will be redirected to the next page, which allows you to check out the vendor list from the dropdown menu. Once you select the vendor, you will be redirected to the next page for the district registration of your property. Now, make payment with your preferred payment option.

AP Registration Market Value

Applicants can seek up the market value of agricultural and non-agricultural property in Andhra Pradesh in 2021 on the official website of the Andhra Pradesh Land Registration & Property Registration department. Here’s a step-by-step guide on determining the market worth of AP stamps and registering them online:

Step 1: Visit the Andhra Pradesh Enrollment and Stamps Department website to obtain the market value of an AP registration (click here).

Step 2: From the left menu, choose the AP registration option labelled “Market Value.”

Step 3: You will be directed to a new page on the AP stamps and registration website to determine the market value of AP stamps and registration. From the drop-down menu, select the village, district, Mandal, and property type.

Step 4: Your screen will show the outcomes of the market value AP.

It should be highlighted that the second wave of COVID-19 had no impact on the market price of land in A.P. in 2021. The same is true for registration market value and AP stamps, which would have gone into effect on August 1, 2021. The Andhra Pradesh government announced that the market value of properties currently registered in the state will be valid until March 31, 2022.

Recompensation of Stamp Duty

It is possible to obtain a refund of the stamp duty paid by the property buyer. However, if stamp duty reimbursement is claimed, the maximum duration is six months in Andhra Pradesh. If the petition is filed within six months, the individual is eligible for a refund, less a 10% deduction from the total amount paid.

According to Section 2(9) of the I.S Act, if an individual wishes to obtain a refund through a sub-registrar, they must submit a refund request along with the original receipt of the specific bank as well as the challan to the District Collector/Deputy Collector/Sub-Collector/Tahsildar/R.D.O. A sub-registrar will issue the certificate after the challan has been verified. However, the net refund amount will be a 10% deduction from the total amount of stamp duty paid.

IGRS Andhra Pradesh – Documents to be Necessarily Registered

- Immovable property gift deed

- Non-testamentary documents, including a sale, mortgage, partition, release, or settlement of the real estate, can be used to establish, declare, transfer, limit, or terminate any right, title, or interest in real estate valued at least $100.

- Non-testamental documents requesting or accepting payment in exchange for the establishment, declaration, transfer, restriction, or continuation of any right, title, or interests

- immovable property leases

- Contracts to transfer immovable property for consideration under Section 53A of the Transfer of Property Act, 1882, must be registered if executed on or after the Registration and Other Related Laws (Amendment) Act effective date 2000. These papers would not be legitimate for Section 53A if they were not registered with AP stamps and registration at or after the beginning of the Act.

Registration Fee For a Will

You should note that you don’t require taxes to submit the willing deed to the AP registration & stamps department. On either hand, AP registration costs apply to wills. AP registration will cost Rs 100 plus user fees during the testator’s life. After the testator’s passing, you must register the will in AP for a price of Rs 100. Additionally, you will gather processing expenses at actuals and inquiry fees, comprising batta.

How to do Payment?

By visiting https://www.shcilestamp.com/estamp stateandhra.html, you may get a comprehensive list of e-stamping locations in Andhra Pradesh. You can pay for your AP stamps and registration by issuing a demand draft, a bank transfer, or a check, among other choices.

If you haven’t already done so with the SHCL portal, you must create a login and password. Log in to the website once your ID has been activated. To pay for stamps and registration fees, go to the left-hand menu and select “pay stamp duty.” On the page where you pay for e-stamps online, select Andhra Pradesh from the fall box.

Tap on self-printing of an e-stamping certificate after selecting the state-specific AP registration & stamp duty type. Enter every piece of information on the next page. Choose a payment option to continue with the transaction (debit card, net banking, or UPI). Choose the print e-stamp credentials option after finishing the AP registration and stamp duty payment. The e-stamp certificate’s legitimacy can be determined at www. Shcilestamp.com.

Types of Encumbrance Certificate (EC)

The forms of AP stamps and registration EC encumbrance certificates are Forms 15 and 16. A record of a sale, lease, loan, gift, division, release, and various AP stamps and registrations, among other things, can be found in Form 15. Everything must be entered in Book I, which the registration authorities hold for the exact time frame for which the certification is required, and registered with the appropriate authorities. 16. Form If there are no activities throughout the requested time for the certificate, Form 16 is issued.

Latest News On AP Stamps and Registration

Implementation of Digital stamps & online payment for IGRS AP deed details registration.

According to a report in the Deccan Chronicle, AP stamps & registration would implement digital stamps & online fees for filing IGRS AP deed data at village/ward secretariats. The Andhra Pradesh government and SHCIL have a contract to sell digital stamps. In addition, the government will consent to sell digital stamps to stamp merchants, shared service centers, and village/ward secretariats.

Additionally, soon there will be almost 3,000 digital stamp sales locations. At 37 village/ward statutory bodies across the state, the IGRS AP deed data filing has commenced. In addition, IGRS AP strives to create a process allowing users, user fees, and land tax to be paid at SCHIL centers or through document authors in banks using challans.

There will be no price increases in the market until March 31, 2022.

Up to March 31, 2022, the Andhra Pradesh government has opted against raising the market value of immovable assets. The state administration has announced that the market value of land in A.P. as of today, 2021, will be in force until March 31, 2022. Furthermore, even though the periodicity of the review was due to start on August 1, 2021, the administration has delayed its implementation until March 31, 2022.

The Bottom Line

Finally, the IGRS AP website provides various services, including viewing encumbrance certificates, certified copies, market value certificates, stamp fee calculation, registration fee calculation, and other user charge calculations. In addition, prohibited property searches, a list of stamp vendors, and various services for citizens unrelated to property registration services and charges, such as registration and firm and society registration, are available. Visit the official website of the IGRS Andhra Pradesh at www.registration.ap.gov.in.

FAQS

What exactly is IGRS AP?

The IGRS AP, also known as the Inspector General of Registration & Stamps, Andhra Pradesh, is in charge of collecting stamp duty and registration fees at the time of property transaction and registration.

Which documents are required to register a property in the IGRS AP portal?

The following is a list of the documents required for property registration on IGRS AP. Passport-sized photographs of the buyer and seller, as well as the buyer’s Aadhaar cards, voter ID cards, and passports, are examples of identity cards. CSD issued a current property card (City Survey Department), Original sale deed registered photocopy Utility bill photocopy. A photocopy of the valid document containing the stamp duty payment is required.

What steps are included in Andhra Pradesh’s Stamps & Registration AP department’s land registration procedure?

Keep the abovementioned paperwork on hand, together with the property card, for the Stamps & Registration AP department’s land registration process.

How do I register AP property or land online?

The buyer and seller must visit the sub-office registrar’s office where the property is situated to complete the property’s AP land registration. This can be done partially online by completing AP land registration paperwork or AP land registry documents.

What are the stamp duty and registration fees in Andhra Pradesh (AP)?

In Andhra Pradesh, registration fees are approximately 1% of the total value of the property, while transfer duty is 1.5%, and stamp duty is around 5%.

What is the registration AP document/IGRs deed receipt number?

This receipt for the registering AP document/IGRS deeds data will be given to the individual delivering the document or his designee after being signed by everyone in attendance.